2013年不容忽視的十大科技潮流 Gartner:行動裝置、社群、雲端與巨量資料

未來幾年科技業面臨的主要趨勢是什麼?哪些正在崛起的新勢力絕不容忽視?產業研究機構

Gartner 點名,行動裝置、社群、雲端與巨量資料等將主宰科技業走向。

周二(23日)Gartner分析師 David Cearley 在美國奧蘭多舉行的 SymposIUm/ITxpo 年度科技論壇上,依據未來三年的產業影響力,提出明年必須關注的十項科技趨勢。

面對滿堂科技業人士,Gartner 開宗明義指出,明年企業 IT 部門必須將雲端、社群、行動與資訊謹記在心。

首先入列的是,行動裝置即將進入戰國時代;預計到 2013 年行動電話將取代電腦成為民眾最主要上網裝置,而且 3 年內逾 8 成新銷售手機都將屬於智慧型等級;此外,估計 2015 年前平板佔整體電腦出貨就可增加至 50%,而微軟

Windows 8 將成為僅次於 Android 與

iOS 的第三大作業系統。

與此同時,隨著行動上網躍為主流,Gartner 也估計 HTML5 開發工具將更加普及,而向網路應用靠攏的長期趨勢也無可避免。

另一項要點也是目前正迅速發展的--雲端服務終究會取代電腦成為個人資訊的最佳儲存所;Gartner 強調,IT 產業正走向雲端、社群與行動的整合,其中雲端更扮演著聯繫網的關鍵角色。

而在巨量資料(big data)與分析方面,Gartner 估計今年全球 IT 支出為 3.6 兆美元,明年將超過 3.7 兆美元,其中最主要成長動能將來自巨量資料。

Cearley 也不忘解釋,雖然社群不列在十項之列,但事實上它已深入科技的各個層面,整合並發展出新的運用及意涵。

Cearley 列出的 2013年十大策略性科技潮流包括:

- 行動裝置戰爭

- 行動應用與HTML5

- 個人雲

- 物聯網 (Internet of Things)

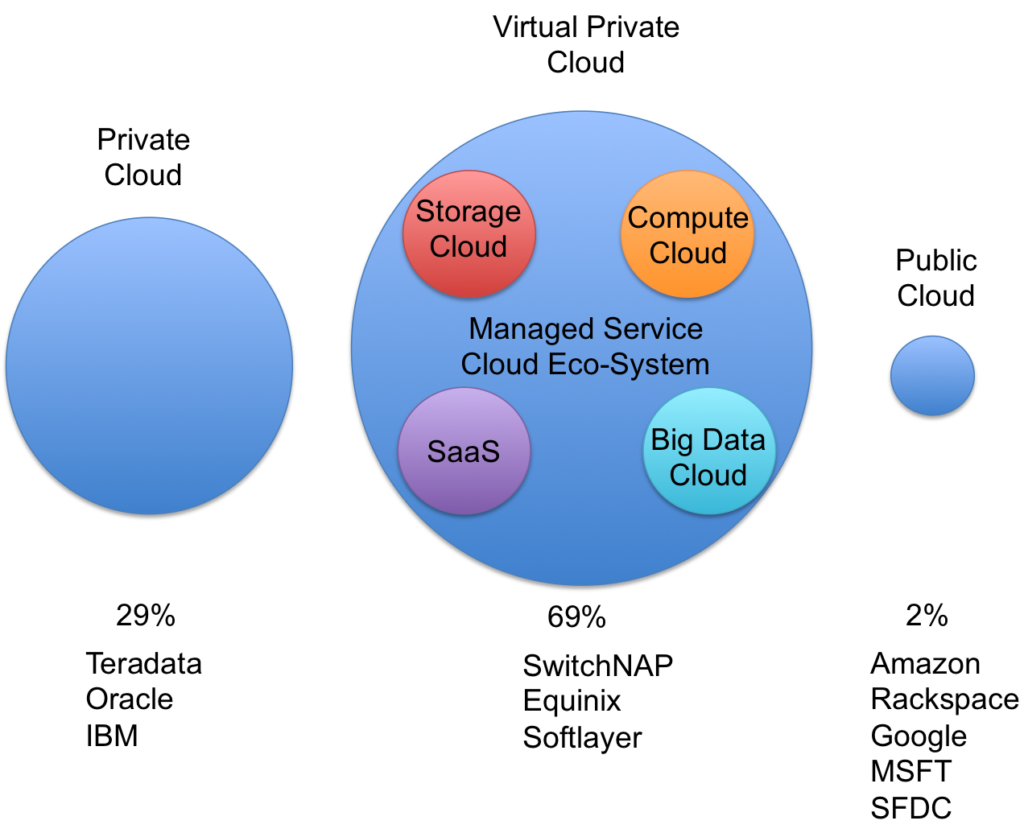

- 混合 IT 與雲端運算

- 策略性巨量資料

- 可行動策略

- 記憶體內運算

- 整合生態系統

- 企業應用程式商店

註:巨量資料之大數據應用將大幅增加,個人混合雲會開始起來;整合生態系統之雲端運算及策略性巨量資料也將形成。

Big Data Revolution? ( 2013年雲端大數據之發展: 大數據革命?)

If you just invested a lot of money in a Big Data solution from any of the traditional BI vendors (Teradata, IBM, Oracle, SAS, EMC, HP, etc.) then you are likely to see a sub-optimal ROI in 2013.

一些創新會在2013年,這將改變大數據的價值指數。其他技術創新,只是在等待智能啟動,將其付諸很好地利用。 Several innovations will come in 2013 that will change the value of Big Data exponentially. Other technology innovations are just waiting for smart start-ups to put them into good use.

Real-Time Hadoop 即時 Hadoop

第一次重大創新將是谷歌

Dremel 的類似的解決方案,如 Impala, Drill的來臨時期,等他們將允許大數據的即時查詢和開源服務。所以,你會得到一個優越的發售相比,什麼是目前免費提供。The first major innovation will be Google’s Dremel-like solutions coming of age like Impala, Drill, etc. They will allow real-time queries on Big Data and be open source. So you will get a superior offering compared to what is currently available for free.

Cloud-Based Big Data Solutions ( 基於雲計算的大量數據解決方案 )

The absolute market leader is Amazon with EMR.

Elastic Map Reduce is not so much about being able to run a Map Reduce operation in the Cloud but about paying for what you use and not more. The traditional BI vendors are still getting their head around a usage-based licensing for the Cloud. Except a lot of smart startups to come up with really innovative Big Data and

Cloud solutions.

Big Data Appliances

你可以買一些真正昂貴的大數據設備,但在這裡破壞性的策略之公司都有可能改變市場。 GPU(圖形處理器)也相對便宜。堆棧到侍服器和使用 likeVirtual 的

OpenCL 的東西,使自己的GPU虛擬化集群解決方案。這些類型的自製GPU集群已經被用於安全大數據相關的工作。You can buy some really expensive Big Data Appliances but also here disruptive players are likely to change the market.

GPUs are relatively cheap. Stack them into servers and use something like

Virtual OpenCL to make your own GPU virtualization cluster solution. These type of home-made GPU clusters are already being used for

security Big Data related work.

同時也希望更多的硬件廠商,移動ARM處理器打包到侍服器裡。戴爾,惠普等已經在推出。想像一下,分佈式的 Map Reduce 的潛力..Also expect more hardware vendors to pack mobile

ARM processors into server boxes.

Dell,

HP, etc. are already doing it. Imagine the potential for Distributed Map Reduce.

最後 Parallella 把一個16核心的超級計算機到每個人的手中,為99美元。其2013年的超級計算機面臨的挑戰是肯定的東西,保持你的眼睛。他們的產品路線會觸及 64和1000的核心版本。如果Adapteva 公司可以保持他們的承諾,並與Parallella充斥市場的預期Parallella集群,成為2013年大數據設備。Finally

Parallella will put a 16-core supercomputer into everybody’s hands for $99. Their

2013 supercomputer challenge is definitely something to keep your eyes on. Their roadmap talks about 64 and 1000 core versions. If

Adapteva can keep their promises and flood the market with Parallella’s then expect Parallella Clusters to be 2013 Big Data Appliance.

Distributed Machine Learning

Mahout is a cool project but Map Reduce might not be the best possible architecture to run iterative distributed

backpropagation or any other machine learning algorithms.

Jubatus looks promising. Also algorithm innovations like

HogWild could really change the dynamics for efficient distributed machine learning. This space is definitely ready for more ground-breaking innovations in 2013.

Easier Big Data Tools

這仍然是一個大的白點在開源領域。有開源和易於使用的拖拉工具為大數據分析真的很讓人接收它。我們已經有了一些良好的商業的例子(Radoop= RapidMiner+Mahout,Tableau,Datameer等),但我們仍缺少良好的開源工具。This is still a big white spot in the Open Source field. Having Open Source and easy to use drag-and-drop tools for Big Data Analytics would really excel the adoption. We already have some good commercial examples (

Radoop =

RapidMiner +

Mahout,

Tableau,

Datameer, etc.) but we are missing good Open Source tools.

Intelligent Applications: The Big Data Theme for 2013 ( 智能應用:2013年巨資料的主題 )

我的預測是2013年的,有競爭力的優勢將轉化為企業使用複雜的巨資料分析的應用 - 創建一個新的品種智能應用程序。My prediction for 2013 is that competitive advantage will translate into enterprises using sophisticated Big Data analytic to create a new breed of applications - Intelligent Applications.

“It’s more than just insights from MapReduce”, a CIO from a fortune 100 told me, “It’s about using data to make our customer touch points more engaging, more interactive, more intelligent.”

所以當你聽到關於“巨資料解決方案”,則需要翻譯成一類新的“智能應用”。在一天結束的時候,它不是關於人看透 Peta Byte的資料。它實際上是關於如何將巨資料轉化為收入(或利潤)。So when you hear about “Big Data solutions”, you need to translate that into a new category of “Intelligent Applications”. At the end of the day, it’s not about people pouring through petabytes of data. It’s actually about how one turns the data into revenue (or profits).

Morgan Stanley named the top ten as follows: ( 摩根士認為前十大應用如下:)

- Healthcare ( 醫療保健 )

- Entertainment ( 娛樂 )

- Com/Media ( COM/媒體 )

- Manufacturing ( 製造業 )

- Financial ( 金融 )

- Business Services ( 商業服務 )

- Transportation ( 運輸 )

- Web Tech ( 網絡技術 )

- Distribution ( 行銷分配 )

- Engineering ( 工程 )

Many have predicted which Industry is the most attractive (see McKinsey’s Quarterly for another). I personally like Ad-Tech and Financial Services for verticals….followed by Information Management , Health (if you can partner to speed up sales cycles), and Communications.

But what about market segments by technology?

我預測,數據分析服務(或簡稱作為作為巨資料服務(BDaaS))將有最高的增長(顯然是建立在它的成熟程度的收入基數較小)。商業智能服務是下一個高速增長的領域,需要更簡單的方法,提出和可視化數據,測井服務。I predict that Data Analytics as a Service (or also referred to as Big Data as a Service (BDaaS)) will have the highest growth (obviously building from a small base in revenue given its level of maturity). Business Intelligence as a Service is the next high-growth segment, given the need for easier ways to present and visualize data, followed by Logging as a Service.

But don’t take my word for this….my data comes from prominent research organizations. I’m just compiling and presenting their data in a slightly new way.

What challenges will end-user organizations struggle with the most in 2013?

End-users will continue to struggle with making sense out of the many technologies available. Is it EMC Greenplum connected to EMC Hadoop? Is it Cloudera Impala + Hadoop? Is it AsterData + Hortonworks? Is it MapR Hbase + HDFS? I think one thing is definite….you have lots of options.

The biggest problem will be whether they are actually satisfying the needs of the business problem. Here are my leading predictions for end-user organizations:

- End users just want to solve problems, but will continue to fight IT over who owns the platform powering their much-needed data-driven applications

- Ultimately, end-users will be forced to chase “shinny objects” because IT groups will persuade them to wait for the “technology bake-offs” around the Big Data platform soon to be launched (24 months from now)

- In the end, many organizations will fail at creating value from Big Data due to a lack of focus on business problems, time-to-market, and in some cases the wrong technology choice

- What are some of the key technologies that will dominate the Big Data market in 2013?

So many equate Big Data with Hadoop. But as you begin to see with announcements like Impala from Cloudera, it’s more than just Hadoop. It’s about servicing all the application response time requirements. It’s about volume, velocity, and variety but also time-to-value with your data analytic.

My prediction for 2013 is that you will need the following technology components:

- Real-time stream processing

- Ad-hoc near real-time analytics (see NoSQL and NewSQL data stores)

- Batch Analytics

- Not one, but all three!

What steps can customers take to maximize competitive advantage with Big Data in 2013?

Time to market 是競爭優勢的所有。我毫不懷疑,全球2000強公司將在2013年推出自己的巨資料平台。問題是,當他們把這些平台推出,需要多長時間的時候到更多的收入,他們聘請 Accenture,CSC,Capgemini,IBM或想實現他們的巨資料之公司,能推出的智能應用程序嗎?Competitive advantage is ALL about time-to-market. I have no doubt that every Global 2000 company will launch their Big Data initiatives in 2013. The question is when they will turn those initiatives into additional revenue…how long will it take from the time that they hire Accenture, CSC, Capgemini, IBM or the like to implement their Big Data strategies, to launching an intelligent application?

Related articles