|

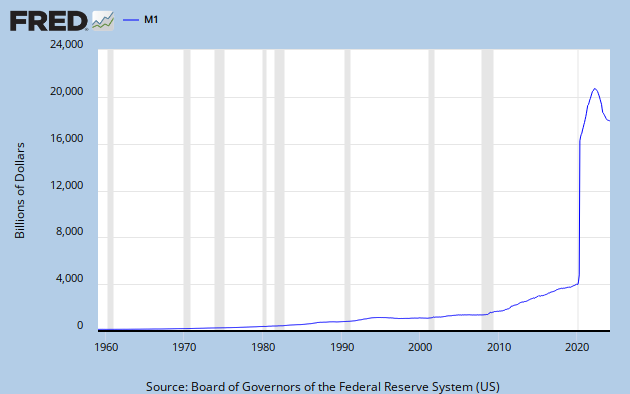

| Fed QE shrink seems a big worry to world wide economic? |

(Reuters) - China and Japan led an exodus from U.S. Treasuries in June after the first signals the U.S. central bank was preparing to wind back its stimulus, with data showing they accounted for almost all of a record $40.8 billion of net foreign selling of Treasuries. ( [路透社] - 六月中國和日本美國國債流出,美國的中央銀行,準備回應刺激的第一信號,數據顯示,他們幾乎賣出創紀錄 408億美元國債。)

The sales were part of $66.9 billion of net sales by foreigners of long-term U.S. securities in June, a fifth straight month of outflows and the largest since August 2007, U.S. Treasury Department data showed on Thursday.

|

| US M1 is still growing |

China, the largest foreign creditor, reduced its Treasury holdings to $1.2758 trillion, and Japan trimmed its holdings for a third straight month to $1.0834 trillion. Combined, they accounted for about $40 billion in net Treasury outflows.Comments from Federal Reserve Chairman Ben Bernanke on May 22 that the central bank could reduce its four-year asset buying or quantitative easing (QE) program by September fueled a sell-off in U.S. Treasuries. ( 中國最大的外國債權人,降低其國債的持有至12758億美元,,日本為連續第三個月削減其持有10834億美元。)

"China's net selling of U.S. treasury could be a reaction to the possible QE exit," said a senior economist at the Chinese Academy of Social Sciences (CASS), a top government think-tank. ( ”在中國社會科學院(CASS),前政府智囊機構中國社科院高級經濟師說:“中國淨賣出是因為美國國債可能是量化寬鬆政策退出的反應 )

Speaking on condition of anonymity, he said China's currency reserves management had become much more pro-active."Holding too much U.S. debt is not wise at a time when Treasury yields rise and prices fall. On the other hand, the adjustment has been marginal considering China's massive holdings of U.S. debt, and China cannot dump U.S. debt, which could spook markets and upset the U.S. government," he said.

But Bank of Thailand Deputy Governor Pongpen Ruengvirayudh said the decision to reduce Treasury holdings was not a new one taken in light of the Fed's tapering expectations. "We have adjusted (our strategy on the U.S. Treasury in the foreign reserves) for a while," she told reporters.

BIGGEST SINCE 1977

U.S. 10-year yields jumped to a two-year high of 2.823 percent on Thursday after encouraging jobless claims data. The yields had hit a high of 2.6670 percent in June after trading in a range of 1.6140 to 2.2350 percent in May. In April, benchmark yields were trading below 2.0 percent.

"The sell-off in Treasuries and Bernanke's tapering remarks are related," said Michael Woolfolk, global market strategist at BNY Mellon in New York. "Lightning doesn't strike in the same place twice, but Bernanke repeated his comments in June and that roiled the market."

Woolfolk said the net Treasury outflow was the highest since at least 1977 when the government started compiling the data.

A Japanese policymaker however said the fears of Fed tapering weren't behind the sales. The market volatility caused by changing expectations around Fed policy might have forced some Asian central banks to intervene to defend their currencies, and in the process reduce their Treasury holdings, he said.

"I don't think Fed tapering expectations had much to do with the selling of U.S. Treasuries," the Japanese policymaker told Reuters.

June was the fifth straight month that foreign investors sold long-term U.S. securities, but the specific selling of long-term government bonds was the big turnaround as foreigners had bought $11.3 billion of Treasuries in May.

And more recent data from the Federal Reserve showed foreign central banks' holdings of U.S. securities fell $2.7 billion to $3.3 trillion in the week ended August 14.

Including short-dated assets such as bills, overseas investors sold a net $19 billion in assets in June, compared with inflows of $56.6 billion the previous month.

U.S. stocks were also out of favor. Foreigners pulled $26.841 billion out of equities in June after selling $8.62 billion in May. Foreigners also sold $5.2 billion in U.S. agency debt, after selling $10.3 billion in May.

註:只要中國、日本持續賣出美國公債,轉移至其他資產,美公債利率就會彈升,就會同時影響美國利率市場,最明顯就是美國房貸市場,看美國不動產證卷商品 ETF指標、美公債及高收債 ETF 指標就可看見危機;

若九月QE預期開始緊縮,那幾個指標值得觀察

全球靠美國印鈔、美債來刺激經濟,當美國不再印鈔必然要收回海外美元,這時亞洲許多國家經濟必然衰退、股市必然要跌。雖美國欠全世界錢,但全世界卻是靠美國債來刺激經濟,全世界其他出超國家若不願意改變消費國家,就必然一直靠美國債來讓經濟成長。

現在多了另一變數,當美國縮小QE時,若中國、日本持續賣出美國公債,美公債利率就會彈升,美國利率市場會受刺激、房貸車貸利率都會上升,美股就會大修正、美國不動產證卷 ETF、美國汽車股、美國公債 ETF及美股就會大修正;

我們來觀察幾個有代表性之 ETF看相關指標 :

1. 很明顯美國不動產證卷 ETF已經破前低,這指標要仔細追蹤。

2. 美國長期公債 ETF 已經跌破 2012 低點,美國公債 ETF指標成為另一重點

3. 全球資金大逃竄,避險市場將熱 - 避險ETF指標

美國Fed主席柏南克預告美國將結束QE,確實要真正檢驗美國景氣是否會隨QE逐漸緊縮而能成長,預估美國是可以逐漸緊縮QE,但要花三年時間。由代表債卷值利率的 TYX 、 TLT 皆以一根長紅決定大幅資金逃竄日子,當利率跳升時,美國金融業 QE 時自美國流出至新興市場低利率資金就會回美,所以,代表新興市場指標之重點市場值得追蹤;

美國金融業 QE 時,大量低利率讓金融業去炒作新興市場及股市,金融業獲利驚人,當 QE 縮減時,金融業投資成本升高獲利下降,美國利率市場會受刺激、房貸車貸利率都會上升,貸款業務也可能縮減,因此汽車業也是另一重點。

5. 美國汽車產業是重要景氣觀察成為另一重點。

總之,九月 QE 預期開始緊縮,美公債利率就會彈升,美國利率市場會受刺激、房貸車貸利率都會上升,美股就會大修正,期待美國景氣指標來讓修正後之美股大反彈,中國、日本加速賣出美國公債未必是壞事,讓美國景氣真正接受檢驗;

本來是預期美聯儲縮QE 美元升值,但一旦發生中國和日本資金自美國國債流出,剛好是中國和日本資金流出,美公債利率就會彈升,美系資金就必須流回美國,因此,美元最終霸權金融武器就必須對資金流出公債之應戰,這兩大力量對抗將是 8 ~ 10 月國際大戲;

外資淨匯入 7月M1B日均創新高

中央銀行今天(26日)公布7月M1B和M2貨幣總計數。被視為觀察股市動能指標的M1B,日平均值達到新台幣12.8兆,創下新高,央行表示,主要是外資呈現淨匯入所致。對於近期外資因美國寬鬆貨幣政策減碼而從亞洲撤資,導致印度和印尼貨幣驟貶,央行認為,主要是因為當時QE實施時,外資投入東南亞的資金較多。

中央銀行26日公布7月貨幣總計數M1B和M2,被視為觀察股市動能指標的M1B,年增率上升為8.63%,創下2011年4月以來新高;至於被作為央行貨幣政策中間目標的M2,年增率上升為5.42%,也是近2年多來的新高。

央行表示,這個結果除了因為去年比較基期較低,也和外資在7月呈現淨匯入有關。央行經濟研究處副處長陳一端說:『(原音)6、7月M1B成長都比較高,和去年的基期有一點關係。因為去年6、7月可能是證所稅的問題,那時外資有出去,所以基期相對比較低。去年7月份外資出去將近28億,今年7月進來將近27.68億。』

對於美國聯準會(Fed)釋出減碼量化寬鬆貨幣政策,使得外資從東南亞國家大舉撤出、回流美國。央行認為,主要是之前QE開始實施時,外資大舉進駐東南亞,現在QE縮減規模,當然資金撤出也會相對比較多,才會使得東南亞國家貨幣呈現大幅貶值。至於QE縮減是否影響台灣的經濟成長率?央行認為,台灣的經濟成長率下半年想要大幅揚升,還是得靠出口表現,若先進國家像是美國、日本和歐洲的經濟能夠好轉,台灣今年GDP保2%絕對不會有問題。

亞洲資金大逃亡 台幣逆勢反升

中國人民銀行的外匯持有增加5.6%。今年以來,亞洲包括中國大陸、台灣、南韓、俄羅斯等國家持續增加,我國央行公布截至7月底為止的外匯存底達4,091億1,800萬美元,較6月底增加25億1,200萬美元,再創新高。

全球外匯準備高達11兆2千億美元,中國人行持有外匯所占比重已達31%,排名第一,我國僅次於中國大陸、日本、俄羅斯排名全球第四高。外資分析師普遍認為,台灣因為外匯存底、經常帳餘額高和外部債務穩健,因此受到這波資金大撤逃的影響不大。

註:央行只要將 6 ~ 24 個月人民幣定存利率調高、多元人民幣商品,將人民幣換匯成本降低,許多外資未投入股市、債卷,自然會投入人民幣定存就會穩定住台幣匯率,同時讓外資將短期套回轉成長期駐留資金。