| Image via Wikipedia |

這例子一開始政府願意增加負債2000萬元、銀行願意負債 4000萬元、創業地主願意負債 6000 萬元,三年後地主的投資回收1.2億元,還擁有價值10.8億之公司股票,這就是資本主義鼓勵人們投資之誘因。資本主義製造工作機會及經濟成長之過程需要有人願意先負債,銀行願意印鈔寬鬆之利率,也就是說資本主義是從負債及銀行印鈔開始的。有人要工作機會及經濟成長,就要有人要負債、有人要印錢及有人要投資。基本上,土地抵押給銀行之條件是土地不是一直貶值的,也就是說資本主義存在另一條件:我們都接受微幅通膨,如果是通縮環境,沒有人願意借錢創業或擴大業務,股市上市本益比會低於8,銀行一堆錢存款利率會是負的,所有資產都在跌價,整個資本主義進入黑洞般之塌陷。( Due to investor wants to invest and form a company to put his asset to loan from bank as debt, this create jobs, economic and GDP growth; company success and IPO to stock market make the investors happy about his investment behavior : as debt 1st when I like to be an investor and believe it is inflation world; if it is a deflation world, it will be a nightmare to capitalism and no one want to invest, no one is dare to put his asset to loan from bank to start-up his company due to asset will drop and fall in deflation world, then, this behavior will turn this investor into bankrupt )

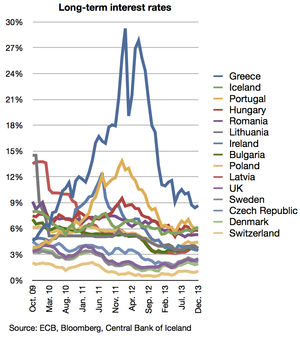

因為極端通縮,所有人都不再投資,銀行一堆錢存款利率形成負的,失業率超高,人們降到基本需求,多餘之產品都被人們遺棄,所以一家一家公司倒閉,失業率持續惡化,政府稅收大幅下降,政府福利支出卻因補貼失業者而上升,GDP大幅下降,政府公債信評也持續下降。( In extreme of deflation, people don't invest, bank interesting rate becomes negative due to all money surge into bank and cease the investment activities, people only seek for basic need and desire, extra need from product also go down a lot, so a lot of companies start to close and bankrupt, jobless rate goes higher and higher, the gov. expense relative to jobless and social benefit increase, GDP drop a lot, the credit of bond of gov. become worst and worst )

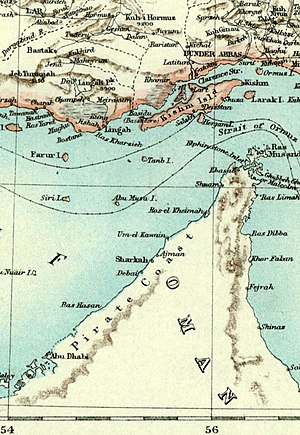

德國強硬之歐盟政策正在引爆一場史無前例的通縮現象,雖不完全一樣,卻極為類似,德國發債利率形成負的、西班牙失業率創史上新高、西班牙等四國一家一家公司開始倒閉、西班牙等四國 GDP大幅下降、政府公債信評也持續下降,你能說現像不一樣嗎? ( Germany thinking on dealing of Europe debt crisis will lead to a terrible deflation, even, it is not all the same, but it is very very close, Germany bond of interesting rate went into negative, Spain jobless rate raise to a history higher point, a lot of companies start to bankrupt in Spain and high debt countries, the GDP of those countries drop a lot and its debt just reduce a few, the credit of bond of those countries also drop and fall month by month, can you say it is different from a deflation? Does Germany know Germany is a shit and cower in this crisis? )

勸亞洲及美國大家勿買歐債,歐盟自已不運用資本主義基本解決方法 : 印鈔買債讓歐元下滑貶值,使歐豬四國出口與觀光業競爭力增加,難道要亞洲及美國來幫歐洲印嗎? 讓德國自已搞清楚歐盟需要讓歐洲高負債國中央銀行自已印印鈔買債 ( 這樣歐洲高負債國之公債就不會違約,投資公債風險轉成為貨幣貶值 ),讓他們用資本主義基本方法解決他們過去高負債錯誤之行為,這樣全世界就不需要一直受歐債影響經濟正常發展。 ( I suggest all Asian and US people don't buy any bond from Europe due to Germany create a shit of economic crisis to the world, if they don't print their Euro to pay those countries debt, why Germany want to form EU? If Germany doesn't understand this is the basic principle of capitalism, how can they lead EU, Germany doesn't try to depend on other countries to print money for Germany to earn, Germany doesn't understand Germany work too hard in avoiding inflation in Germany and make other countries in deflation, it is not a debt issue, it is a Germany fault to shrink too much in Europe budget to cause GDP of those countries fall and keep the same debt, so its credit of bond will drop a lot )

![Wheat Field [E-X-P-L-O-R-E-D]](http://farm3.static.flickr.com/2660/3715569167_7e978e8319_m.jpg)