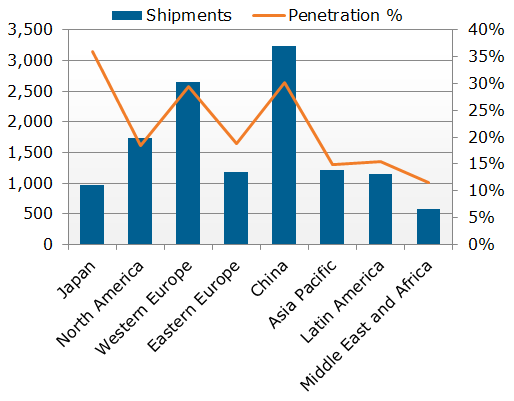

FRAMINGHAM, Mass. March 4, 2013 – More smartphones are forecast to be shipped globally than feature phones in 2013, the first such occurrence in the mobile phone market on an annual basis. According to the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, vendors will ship 918.6 million smartphones this year, or 50.1% of the total mobile phone shipments worldwide. 首次出現在手機市場上一年度的基礎上智能手機預計會在2013年超越功能手機全球出貨量。據國際數據公司(IDC)全球季度手機跟踪,供應商將出貨9.186億部智能手機,今年,或佔全部手機的全球出貨量的 50.1%。

Smartphone prices have fallen globally, the smartphone strata are wider than ever, and the roll-out of data-centric fourth-generation (4G) wireless networks are three factors that have made these “do-it-all” devices an increasingly attractive option for users. By the end of 2017, IDC forecasts 1.5 billion smartphones will be shipped worldwide, which equates to just over two-thirds of the total mobile phone forecast for the year due to these primary factors. 在全球智能手機的價格已經下降,智能手機的階層比以往任何時候都更廣泛,轉出的數據為中心的第四代(4G)無線網絡三個方面的因素,都使得這些“做它,所有的”設備越來越具有吸引力的選擇供用戶使用。到2017年底,IDC預測15億的智能手機將出貨至世界各地,相當於剛剛超過三分之二的手機總預測今年以來,由於這些主要因素。

To date, much of the world’s smartphone shipments were a direct result of demand in mature economies such as the U.S. The balance of smartphone demand is gradually shifting, however, to emerging markets where smartphone user bases are still relatively small and economic prospects are considerably higher. Smartphone shipments to China, Brazil, and India will comprise a growing percentage of the device type’s volume in each forecast year. Smartphone demand is burgeoning in these large, populous nations as their respective economies have grown; this has made for a larger middle class that is prepared to buy smartphones. China, which supplanted the U.S. last year as the global leader in smartphone shipments, is at the forefront of this shift. 至目前

求的平衡需求的逐步轉移,然而,新興市場在那裡智能手機用戶基礎是仍然比較小和經濟前景是相當高的。中國,巴西和印度的智能手機出貨量將包括在每個預測年度的設備類型的量越來越大的百分比。新興的智能手機需求大,人口眾多的國家,各自的經濟增長,取得了較大的中產階層,準備購買智能手機。中國,去年取代美國作為全球領先的智能手機出貨量,是這種轉變的最前沿。

“While we don’t expect China’s smartphone growth to maintain the pace of a runaway train as it has over the last two years, there continue to be big drivers to keep the market growing as it leads the way to ever- lower smartphone prices and the country’s transition to 4G networks is only just beginning,” said Melissa Chau, Senior Research Manager, IDC Asia/Pacific. “Even as China starts to mature, there remains enormous untapped potential in other emerging markets like India, where we expect less than half of all phones shipped there to be smartphones by 2017, and yet it will weigh in as the world’s third largest market.” “雖然我們不指望中國的智能手機的增長,在過去兩年保持的步伐,因為它有一個失控的火車,繼續有大的驅動程序,以保持市場的增長,因為它導致的方式來不斷降低智能手機價格該國過渡到4G網絡才剛剛開始,說:“梅麗莎洲,高級研究經理,IDC亞洲/太平洋。 “即使中國開始走向成熟,有仍然是巨大的尚未開發的潛力在其他新興市場,如印度,在那裡我們預期少超過一半的所有手機出貨有到是智能手機,到2017年,和但它會權衡在作為世界第三大市場。 “

SMARTPHONES, MOORE'S LAW AND RADICAL MOBILE VALUE SHIFT

Article in The Economist today on the trends in Smartphones:

Prices are now on a downward spiral, says Ben Wood of CCS Insight, a research firm. Several other handset-makers are already offering cheap smart-phone-like devices. Android allows cut-price Chinese firms such as Huawei and ZTE to enter the smart-phone market, which they had previously stayed out of for lack of the necessary software. Last month T-Mobile, a mobile operator, gave a taste of things to come. Its British subsidiary started selling the Pulse, an Android-powered smart-phone made by Huawei, for only £180. (The cheapest iPhone model sells for £340 in Britain if bought without a contract.)

If you take this trend and extrapolate according to Moore's Law, in about 9-10 years time (depending on your inflation assumptions) you get a sub £10 device that is as powerful as today's

iPhone. (See chart above) What happens globally then, when the poorest of people can afford comms and computing like this. And what does £300 buy then - a 30x more powerful device at the same size, a device as powerful as today's at 1/30th the size. What opportunities does this drive? What happens as RFID prices lso fall and we can integrate to penny-price "Internet of Things" devices. 如果這一趨勢,並根據摩爾定律推斷,在9-10年左右的時間(根據您的通貨膨脹率假設的),你會得到一個子£10台設備,是今天的iPhone一樣強大。 (見上圖),會發生什麼情況全球範圍內,最貧窮的人能夠負擔得起這樣的通訊科及計算。什麼£300買入 - 30倍的更強大的設備在相同的大小,一個強大的設備,為今天的三十分之一的大小。該驅動器什麼樣的機會?會發生什麼事,我們可以把

RFID價格萊索托下降到一分錢的價格“互聯網物聯網”設備。

Answers are unclear, but one thing is for certain - as The Economist notes:

All this reflects a broader trend in the industry, where value is migrating from firms that run networks and make hardware to those that make software and offer services (see article). 所有這一切都反映了更廣泛的行業趨勢,從企業運行的網絡和硬件,使軟件和提供服務(見文章)的遷移值。

Interesting times are set to continue for another 10 years at least.

三星新興市場暴衝、八員高低通吃!智慧手機大廠拉警報

正當外界聚焦在三星要價數百美元的最新旗艦高階手機 Galaxy S4 之時,三星卻早已在新興市場低調備妥多款「百美元智慧手機」火力強大武器,準備以低階機海戰術,攻進諾基亞主戰場,並為未來十年在新興市場的高階智慧手機發展鋪路。

《華爾街日報》報導,今年截至目前為止,三星一共推出八款手機,其中僅 S4 為高階手機,其餘低階手機售價不到一百美元,主要銷售市場包括印尼、印度。

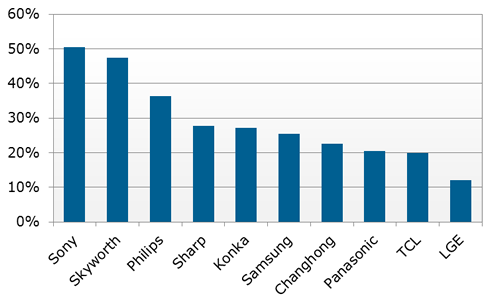

不同於蘋果只專注在高階手機市場,三星也透過推出低價手機在全球市場上衝量,並逐步蠶食諾基亞與黑莓的市占率。2012 年是三星豐收的一年,根據調研機構 Strategy Analytics 的統計,智慧手機市場三星以市占率 30.4% 取得領先,同時就整體手機出貨量而論,三星踢掉諾基亞以 25.1% 的占有率拔得頭籌。

三星共同執行長申宗均(J.K. Shin)指出,三星在低階智慧市場相當活躍,未來也將繼續競逐這塊市場。在印尼,消費者一批批揚棄功能手機轉向智慧手機,因此低階智慧手機市場正快速地蓬勃發展。

低階手機蝕獲利 三星不正面回應,只稱有利可圖!

分析師對低價手機市場擴張提出警告,指此舉長期下來會侵蝕掉企業獲利,從而傷害三星的盈餘與品牌形象。針對這項疑問,三星不願回應,只說低階行動設備對公司而言仍是有利可圖。

香港 Sanford Bernstein 投資分析師 Mark Newman 預估,三星低階智慧手機營利率約 12%,高階智慧手機營利率 28%,功能手機營利率 2% 至 3%。

《華爾街日報》報導,在印尼雅加達,過去購物中心販售手機樓面隨處可見黑莓機的招牌,如今卻是被三星藍色圖騰淹沒,蘋果 iPhone 的廣告招牌不多,店主告訴記者,店內最熱賣的手機品牌就是三星。根據 Canalys 統計,在印尼,iPhone 市占率不到 1%,可怕的是,三星在「智慧手機」市場占有率卻從 2010 年的 2% 暴增至上季的近五成。三星成功的秘訣,就是能提供不同價格帶的商品,品項齊全,從最低的數十美元的功能手機到 600 美元的智慧手機都有賣。

2 月,三星推出中階智慧手機 Galaxy Young 與 Galaxy Fame,上述系列智慧手機螢幕較小、記憶體容量較小、相機鏡頭像素較弱。2 月底,三星又推出四款 REX 系列功能手機,每台售價在 50 美元至 100 美元之間,主要銷售市場為印度、中東、東歐、以及南美。20 日,三星也在香港推出 GALAXY Express 中低階 4G LTE 手機。

三星申宗均指出,REX 功能手機銷售奇佳,但這款手機不計劃在美上市。

低階手機市場為何是諾基亞、三星兵家必爭之地

低階手機市場競爭激烈,諾基亞在去年夏天推出不到 100 美元的觸控螢幕功能手機 Asha,手機許多功能也直逼智慧手機,也擁有社群應用程式如推特,因此頗受歡迎,在部份新興市場的業績表現優於搭載 Android 作業系統的低階手機如三星 Galaxy Mini 與 Galaxy Y。

諾基亞之後又再推出售價 20 美元(不含稅與電信商補貼)的低階手機 Nokia 105。而為迎戰諾基亞,三星還會再推出更多的低階手機,希望能打動新興市場消費者的心、建立消費者與品牌的關係、同時打穩通路。往後消費者要換智慧手機,三星較能輕鬆獲得青睞,為未來十年在新興市場的銷售鋪路。

由分析得知幾大趨勢:

Article in The Economist today on the trends in Smartphones:

Prices are now on a downward spiral, says Ben Wood of CCS Insight, a research firm. Several other handset-makers are already offering cheap smart-phone-like devices. Android allows cut-price Chinese firms such as Huawei and ZTE to enter the smart-phone market, which they had previously stayed out of for lack of the necessary software. Last month T-Mobile, a mobile operator, gave a taste of things to come. Its British subsidiary started selling the Pulse, an Android-powered smart-phone made by Huawei, for only £180. (The cheapest iPhone model sells for £340 in Britain if bought without a contract.)

iPhone. (See chart above) What happens globally then, when the poorest of people can afford comms and computing like this. And what does £300 buy then - a 30x more powerful device at the same size, a device as powerful as today's at 1/30th the size. What opportunities does this drive? What happens as RFID prices lso fall and we can integrate to penny-price "Internet of Things" devices. 如果這一趨勢,並根據摩爾定律推斷,在9-10年左右的時間(根據您的通貨膨脹率假設的),你會得到一個子£10台設備,是今天的iPhone一樣強大。 (見上圖),會發生什麼情況全球範圍內,最貧窮的人能夠負擔得起這樣的通訊科及計算。什麼£300買入 - 30倍的更強大的設備在相同的大小,一個強大的設備,為今天的三十分之一的大小。該驅動器什麼樣的機會?會發生什麼事,我們可以把

RFID價格萊索托下降到一分錢的價格“互聯網物聯網”設備。

Answers are unclear, but one thing is for certain - as The Economist notes:

All this reflects a broader trend in the industry, where value is migrating from firms that run networks and make hardware to those that make software and offer services (see article). 所有這一切都反映了更廣泛的行業趨勢,從企業運行的網絡和硬件,使軟件和提供服務(見文章)的遷移值。

Interesting times are set to continue for another 10 years at least.

三星新興市場暴衝、八員高低通吃!智慧手機大廠拉警報

正當外界聚焦在三星要價數百美元的最新旗艦高階手機 Galaxy S4 之時,三星卻早已在新興市場低調備妥多款「百美元智慧手機」火力強大武器,準備以低階機海戰術,攻進諾基亞主戰場,並為未來十年在新興市場的高階智慧手機發展鋪路。

《華爾街日報》報導,今年截至目前為止,三星一共推出八款手機,其中僅 S4 為高階手機,其餘低階手機售價不到一百美元,主要銷售市場包括印尼、印度。

不同於蘋果只專注在高階手機市場,三星也透過推出低價手機在全球市場上衝量,並逐步蠶食諾基亞與黑莓的市占率。2012 年是三星豐收的一年,根據調研機構 Strategy Analytics 的統計,智慧手機市場三星以市占率 30.4% 取得領先,同時就整體手機出貨量而論,三星踢掉諾基亞以 25.1% 的占有率拔得頭籌。

三星共同執行長申宗均(J.K. Shin)指出,三星在低階智慧市場相當活躍,未來也將繼續競逐這塊市場。在印尼,消費者一批批揚棄功能手機轉向智慧手機,因此低階智慧手機市場正快速地蓬勃發展。

低階手機蝕獲利 三星不正面回應,只稱有利可圖!

分析師對低價手機市場擴張提出警告,指此舉長期下來會侵蝕掉企業獲利,從而傷害三星的盈餘與品牌形象。針對這項疑問,三星不願回應,只說低階行動設備對公司而言仍是有利可圖。

香港 Sanford Bernstein 投資分析師 Mark Newman 預估,三星低階智慧手機營利率約 12%,高階智慧手機營利率 28%,功能手機營利率 2% 至 3%。

《華爾街日報》報導,在印尼雅加達,過去購物中心販售手機樓面隨處可見黑莓機的招牌,如今卻是被三星藍色圖騰淹沒,蘋果 iPhone 的廣告招牌不多,店主告訴記者,店內最熱賣的手機品牌就是三星。根據 Canalys 統計,在印尼,iPhone 市占率不到 1%,可怕的是,三星在「智慧手機」市場占有率卻從 2010 年的 2% 暴增至上季的近五成。三星成功的秘訣,就是能提供不同價格帶的商品,品項齊全,從最低的數十美元的功能手機到 600 美元的智慧手機都有賣。

2 月,三星推出中階智慧手機 Galaxy Young 與 Galaxy Fame,上述系列智慧手機螢幕較小、記憶體容量較小、相機鏡頭像素較弱。2 月底,三星又推出四款 REX 系列功能手機,每台售價在 50 美元至 100 美元之間,主要銷售市場為印度、中東、東歐、以及南美。20 日,三星也在香港推出 GALAXY Express 中低階 4G LTE 手機。

三星申宗均指出,REX 功能手機銷售奇佳,但這款手機不計劃在美上市。

低階手機市場為何是諾基亞、三星兵家必爭之地

低階手機市場競爭激烈,諾基亞在去年夏天推出不到 100 美元的觸控螢幕功能手機 Asha,手機許多功能也直逼智慧手機,也擁有社群應用程式如推特,因此頗受歡迎,在部份新興市場的業績表現優於搭載 Android 作業系統的低階手機如三星 Galaxy Mini 與 Galaxy Y。

諾基亞之後又再推出售價 20 美元(不含稅與電信商補貼)的低階手機 Nokia 105。而為迎戰諾基亞,三星還會再推出更多的低階手機,希望能打動新興市場消費者的心、建立消費者與品牌的關係、同時打穩通路。往後消費者要換智慧手機,三星較能輕鬆獲得青睞,為未來十年在新興市場的銷售鋪路。

由分析得知幾大趨勢:

- 新興經濟國無線移動上網人口大增,這趨勢會帶來許多新機會;

- 上網人口大增;電視、平板電腦、智慧手機,以及機器對機器(M2M)模組等新興設備的流量成長率卻預計將分別達到101%、216%、144%以及258%。平板電腦、PC、筆電及智能手機成長在於全球上網人口。

- 低價 4.7 inch ~ 5.7 inch 智慧型手機將盛行;Phablet 成一趨勢;

- 智慧型手機與平板電腦改變人們之習慣趨勢與影響;

- 2013 全球智慧型手機出貨超越8億支,高價與低價智慧型手機 M 化加大;低價智慧型手機將是 99 美元;

- 移動應用軟體機會大增;

- Samsung 獨霸手機市場,成功的策略;