根據市場研究機構Gartner的最新報告指出,2015年第二季全球PC出貨量呈現衰退9.5%,而IDC認為衰退的現象比預期嚴重,預測衰退幅度達到兩位數字的11.8%。兩家研究機構調查結果顯示2015年第二季年成長率非常接近兩位數字,這給PC的未來又再一次壟罩了陰影。

IDC認為2015年第二季全球PC出貨量達到6614萬台。這一數字略低於IDC先前預期。主要原因在於2014年第二季,由於微軟不再支援Windows XP,因而許多消費者在這時間點讓其Windows XP升級至更新版本的系統,帶來較高的PC出貨量,這也造成2015年第二季的PC成長率不佳。

IDC認為2015年第二季全球PC出貨量達到6614萬台。這一數字略低於IDC先前預期。主要原因在於2014年第二季,由於微軟不再支援Windows XP,因而許多消費者在這時間點讓其Windows XP升級至更新版本的系統,帶來較高的PC出貨量,這也造成2015年第二季的PC成長率不佳。IDC與Gartner一致性的看法則是,美元匯率的增強使得其他貨幣減弱而造成PC平均價格上漲,因而抑制了PC的出貨量。另外一個重要因素是,隨著Windows 10作業系統即將推出,這讓PC市場呈現觀望的氣氛非常濃厚,所以PC通路商傾向清理既有庫存的PC產品,所以沒有向PC廠商進貨,也造成了2015年第二季出貨不如預期。

IDC認為2015年第二季PC出貨量太差並不值得擔憂。因為這一下滑的情況其實符合預期,只要Windows 10上路幾年且美元相對穩定之後,PC市場將趨於平穩。即使如此,2015年下半年PC仍將出現中低個位數比例的出貨量下滑。簡單來說,Windows 10推出的第一年對於PC產業的貢獻不會那麼明顯。

更何況微軟允許原本採購Windows 7和Windows 8.1的個人電腦用戶可以於一年內免費升級至Windows 10作業系統,因此許多用戶很可能就不會在第一年購買新PC,而是直接在舊有的PC上進行升級。到了2016年下半年買氣才會慢慢出籠。

IDC認為全球前五名PC廠商中,只有蘋果是呈現正成長的情況,出貨量達513.6萬台,比起2014年第二季的442.3萬台,年成長率達16.1%。這是因為蘋果不需要參與其他Windows PC廠商的價格戰,只要依循著自己的步調,以及透過蘋果零售商店來吸引用戶即可。

可是,Gartner似乎認為蘋果的麥金塔出貨量沒有突破456萬台,因而被排出在全球前五大PC廠商的行列之中。Gartner認為蘋果於美國PC市場,依舊呈現2.5%的衰退,IDC卻認為有11.9%的正成長。這兩家公司的爭議,或許要等到蘋果真正公布其2015年第二季麥金塔出貨量才能見真章。

PC sales drop sharply again in Q3; Apple, HP, Lenovo gain share

- IDC estimates global PC shipments fell 10.8% Y/Y in Q3 to nearly 71M units, a drop nearly as large as Q2's 11.8% and above a 9.2% projection. Gartner estimates shipments fell 7.7% to 73.7M.

- IDC: "Across many regions, the channel remained focused on clearing Windows 8 inventory before a more complete portfolio of models incorporating Windows 10 (NASDAQ:MSFT) and Intel (NASDAQ:INTC) Skylake processors comes on the scene ... Though easing a bit, currency devaluation continued to inhibit PC shipments in the third quarter. While Windows 10 has generally received favorable reviews and raised consumer interest in PCs, many users opted to upgrade existing PCs rather than purchase new hardware."

- Nonetheless, IDC is "optimistic" about a demand pickup. "While PC shipments will be hampered in the short run by the availability of a free upgrade to Windows 10, the improved PC experience across user segments should drive longer-term demand for new PC hardware..."

- Likewise, Gartner expects "more stable market conditions" in 2016. It's also pleased the U.S. notebook and "premium ultramobile" segments saw positive growth. Various analysts have reported seeing signs of stabilizing PC demand.

- The market's four biggest players all grabbed share from smaller firms with less scale. IDC estimates market leader Lenovo's (OTCPK:LNVGY) share rose 130 bps Y/Y to 21%, #2 HP's (NYSE:HPQ) 110 bps to 19.6%, and #3 Dell's 120 bps 14.3%.

- Apple (NASDAQ:AAPL), aided by 1H15 MacBook refreshes, came in at #4 with a 7.5% share, up 60 bps (revenue share is likely closer to 15%). A 4K 21.5" iMac is reportedly launching next week.

蘋果第三季 iPhone 及 MAC 成長強勁

Today Apple released their earnings for Q3 of fiscal year 2015, which ended June 27th. In what seems to be a never-ending sequence of records, once again, Apple posted a record third quarter. Revenue for the quarter came in at $49.6 billion, up 33% from a year ago. Gross margin was $19.7 billion, also up 33% from Q3 2014. Operating income was up almost 37% to $14.1 billion, and net income was $10.7 billion for the quarter, a gain of 37.8% year-over-year. Earnings per share was $1.85, up from $1.28 in Q3 2014.

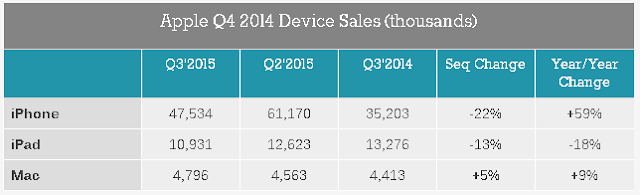

Apple’s iPhone business has been the primary factor in these record breaking quarters, and the iPhone 6 and 6+ sales continued to be strong. For the quarter, Apple sold 47.5 million iPhones, which is a gain of 35% in units. Even more impressive is that these 35% more units resulted in 59% more revenue, with iPhone sales totalling $31.4 billion for this quarter alone.

Mac sales have also been strong, and while Apple has generally outpaced the PC market in sales growth for a while, Apple saw an additional 5% in Mac unit sales for Q4 compared to Q3, and 9% from a year ago. This is at a time where the rest of the PC market is contracting, so Mac sales were an impressive 4.8 million units, with revenue of just over $6 billion for the quarter. The resurgence of the Mac has been quite the rise, with Mac revenue being eclipsed quite a bit by the iPad not very long ago. Times have changed though and Apple’s PC business is currently the only one that has seen an increase in sales according to the reports floated around in the last couple of weeks.

iPad sales though are not so rosy. The iPad sales were very strong, and while sales are not exactly terrible, the number of units being sold has been dropping for some time. Much debate has been about why this is, but certainly owners of the iPad have not felt the need to refresh their devices anywhere nearly as quickly as phones. For the quarter, there were 10.9 million iPads sold, which resulted in revenue of $4.5 billion. The number of units sold is down 13% from Q2, and down 18% year-over year.

Services, which include iTunes sales, AppleCare, Apple Pay, and will include Apple Music in the future, saw a nice jump as well with just over $5 billion in revenue for the quarter. This is up 1% from last quarter, and up 12% from last year.

“Other Products” which is Apple TV, Apple Watch, Beats, iPods, and accessories had a big quarter, and while individual numbers were not announced, it is likely due to initial sales of the Apple Watch which came out in the quarter. For Q3, this group had sales of $2.6 billion, up 56% from last quarter and up 49% year-over-year. Likely most of the increase can be attributed to the Watch, but without knowing average selling price, it would be pretty difficult to try and extrapolate unit sales without more information.

This pipeline post is quite a bit shorter than the Microsoft earnings, but for all of the right reasons. There is less to say when things are going as well as they are for Apple right now. iPhone sales are still a huge part of their balance sheet, and seem to have no sign of slowing down. People obviously wanted a larger iPhone and sales have skyrocketed since the iPhone 6 and 6+ were launched. But I think we were all expecting this based on past performance. I think what is most interesting is how much of the PC market Apple has managed to chip away with Mac sales, which are up an amazing 9% when the rest of the market contracted.

For Q4, Apple is expecting revenue of $49 to $51 billion, with a gross margin of 38.5 to 39.5%.

蘋果雲端儲存服務也是領先群雄

蘋果 (Apple)(AAPL-US) 在眾多科技領域中,都維持領先地位。一份由 Strategy Analytics 所做的調查顯示,在雲端媒體服務,蘋果也是美國榜首, iCloud 及 iTunes Match 市占達 27%,遙遙領先其他競爭者。

- 從蘋果第三季 iPhone 及 MAC 成長強勁,很明顯蘋果是大勝,基本上蘋果以流行性、方便性及實用性打敗競爭對手;

- 從蘋果策略上,使用過蘋果以方便性及實用性,其實會覺得 PC 確實難用又沒效率;

- 分析發現,若 MAC 還存在 Window 雙模 OS 機種,將對 PC 更大衝擊;