|

| Apple Smart TV is ready |

業界推敲,郭董日前發表景氣看法時,曾提出所謂「金蛇出洞日」,也就是今年5、6月間,屆時不排除有iTV出貨的好消息。

一直以來,蘋果iTV「只聞樓梯響,不見人下來」,原本市場預期蘋果將在3月召開與iTV相關的大會,並於9月或10月份正式發售,但外傳因蘋果的液晶面板供應商LG Display Co.(LGD)、夏普,截至目前為止,都還無法達到良率目標,上市日期恐將延至明年,連帶也給了競爭者最佳切入時機。

看準智慧電視商機,外傳郭台銘今年3月親赴日本,與蘋果高級主管面洽,並親自做簡報,雙方見面的地點就選在郭董個人出資的大阪堺市10代面板廠,而非夏普目前替蘋果組裝代工的龜山第一工廠。

由於當時剛好碰到夏普迎新歡三星入股,以致焦點遭到模糊,市場普遍以郭董赴日為鴻夏戀固椿來作解讀,但背後係為了洽談iTV訂單。

據悉,這次與蘋果高層會面過程中,郭台銘不單做足了準備,還出示了某項「秘密武器」,藉以向蘋果證實自己已具有生產蘋果iTV的能力。對於上述報導,鴻海發言體系昨日不予回應,不過業界人士指出此消息的可能性頗高。

|

| Smart content, connected and recognition become a trend in smart TV |

|

| 47 inch smart TV in 699 USD in Amazon |

日本媒體Mynavi News去年12月曾引述華爾街日報報導指出,美國蘋果正在與亞洲零組件供應商共同研發大尺寸電視,文中直接點名所謂的亞洲零組件供應商,指的就是台灣鴻海與日本夏普,但因日前爆出三星入股夏普案,引「三星」入關的夏普,會否因此丟掉iTV大單,又成為市場焦點。

市場推測,蘋果與三星一直存有瑜亮情結,會否因為此因素,棄夏普就鴻海,目前仍有待觀察,但此次蘋果和郭董洽商的地點,不是選在夏普的「蘋果專用工廠」,即龜山第一工廠,而是選在郭台銘個人出資的堺市十代廠,頗不尋常。

註:Apple smart iTV 出現將搶走 15% ~ 20% smart TV 市場,也就是 iPod、iPhone、iPad 使用者市場;

USA: LCD TV panel manufacturers are planning less aggressive business strategies for 2013 as LCD TV demand growth slows, according to the latest NPD DisplaySearch Quarterly LCD TV Value Chain Report.

Panel makers are moving to avoid an oversupply of LCD TV panels. This involves a drastic change in business models, which includes developing strategic alliances, making capacity allocation improvements, and expanding product portfolios to include a larger variety of panel sizes. LCD TV panel manufacturers hope that by moving to larger screen sizes, they can decrease unit shipments while increasing total area shipped, thus boosting their bottom lines.

“Consumers are focused on TV prices, while brands have been focused on TV features. This disconnect has resulted in reduced demand and profits for TV supply chain participants in 2012,” said Deborah Yang, NPD DisplaySearch Research director.

“A misalignment in panel size portfolios between buyers and sellers could result in supply constraints. Panel makers and TV brands are trying to strengthen their business portfolios and enhance their bargaining power with supply chain participants in order to improve profitability and gain a competitive edge.”

Taking these factors into account, along with the aggressive TV shipment plans of some TV brands (in particular the top two Korean TV brands and Chinese TV makers), NPD DisplaySearch forecasts 4 percent Y/Y growth in LCD TV panel shipments for 2013 and 11 percent Y/Y growth in TV shipments planned by surveyed TV brands. Samsung and LG, for example, are working with Sharp to increase panel supply in 2013, mostly for 32” panels.

“Some TV brands’ 2013 shipment plans reflect their strategy to set higher targets and secure sufficient panel supply, but they may also be too aggressive,” said Yang. “The TV supply chain is evolving, with Taiwanese panel makers leading the development of new panel sizes and ties with TV brands. Meanwhile, panel and set makers are adopting new business models around open cell and backlight-module-systems (BMS) assembly. Other TV manufacturers may be forced to follow suit—changing the TV value chain over the long term.”

World smart TV sales surge

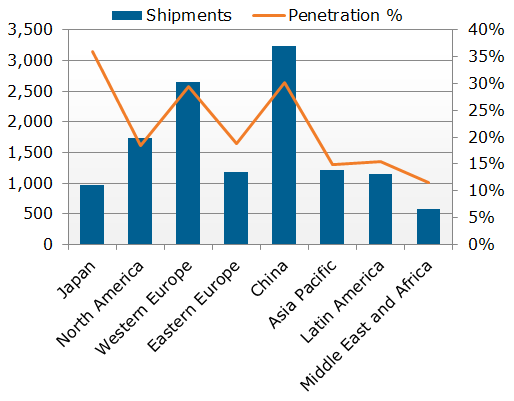

Smart TVs - tellies with internet connectivity - accounted for almost 20 per cent of the televisions that manufacturers shipped in Q1.Almost 30 per cent of them went into Western Europe, but the world's biggest IPTV fans are clearly the Japanese: 46 per cent of the TVs that shipped there were smart devices.

Yet Japanese shipments were low: just under 1m units. More than 2.6m smart TVs shipped into Western Europe, and some 3.2m into China.

Penetration there hit 30 per cent as Chinese buyers snapped up new TVs to help celebrate the Lunar New Year, market watcher NPD DisplaySearch said today.

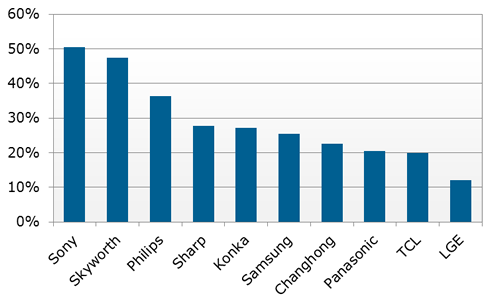

LG and Samsung may have been promoting their smart TV platforms of late, but in Q1, the number of smart TVs they shipped as a proportion of their total telly shipments were just 26 per cent and 12 per cent, respectively.

Compare that to Sony: more than half of the TVs it shipped in the quarter - 51 per cent - were internet connectable.

Other familiar brands - to Westerners - Philips, Sharp and Panasonic scored 36 per cent, 28 per cent and 21 per cent, respectively, according to DisplaySearch's numbers.

Still, it's impossible to yet say how many of these devices are being used for their connected capabilities. Smart TV functionality remains just one television feature among many. China's high sales, for instance, may say more about the growing conspicuous consumption of the Chinese middle class than the keenness of folk there on net-sourced entertainment.

Smart TVs - tellies with internet connectivity - accounted for almost 20 per cent of the televisions that manufacturers shipped in Q1.Almost 30 per cent of them went into Western Europe, but the world's biggest IPTV fans are clearly the Japanese: 46 per cent of the TVs that shipped there were smart devices.

Yet Japanese shipments were low: just under 1m units. More than 2.6m smart TVs shipped into Western Europe, and some 3.2m into China.

Penetration there hit 30 per cent as Chinese buyers snapped up new TVs to help celebrate the Lunar New Year, market watcher NPD DisplaySearch said today.

LG and Samsung may have been promoting their smart TV platforms of late, but in Q1, the number of smart TVs they shipped as a proportion of their total telly shipments were just 26 per cent and 12 per cent, respectively.

Compare that to Sony: more than half of the TVs it shipped in the quarter - 51 per cent - were internet connectable.

Other familiar brands - to Westerners - Philips, Sharp and Panasonic scored 36 per cent, 28 per cent and 21 per cent, respectively, according to DisplaySearch's numbers.

Still, it's impossible to yet say how many of these devices are being used for their connected capabilities. Smart TV functionality remains just one television feature among many. China's high sales, for instance, may say more about the growing conspicuous consumption of the Chinese middle class than the keenness of folk there on net-sourced entertainment.

LCD TV Shipment Growth to Improve in 2012, Driven by 40” and Larger Sizes

SANTA CLARA, Calif., January 3, 2012—Consumer demand for TVs has been softer than expected in 2011, but showing signs of improvement late in the year. However, inventory pressure plagued the industry through much of early 2011 and led to a sharp reduction in shipments to retailers. The result is that global TV unit shipments are expected to rise only 0.1% in 2011. According to the latest forecast released in the NPD DisplaySearch Advanced Quarterly Global TV Shipment and Forecast Report, growth is expected to improve in 2012, rising 2% to 254 million units.

“Global economic conditions have improved in 2011, but more slowly than expected, and consumers in mature TV markets like Europe face continuing uncertainty, which is leading to very cautious spending patterns,” noted Paul Gagnon, Director of North America TV Research for NPD DisplaySearch. Gagnon added, “Because price reductions are not as vigorous as a few years ago, partially due to a mature manufacturing base but also because of transitions to advanced features like LED backlights and 3D, consumers are becoming more willing to wait for peak sale periods to purchase.”

|

| Price drop per year around 10% after 2008 |

Flat panel TV continues to grow, but at a more gradual pace of 2-4% per year as the rapid transition from CRT to LCD and plasma nears an end. LCD TV continues to be the dominant technology on a unit and revenue basis, and in fact seems likely capture even more market share due to a weaker outlook for plasma TV going forward. As LCD narrows the pricing gap with plasma at many sizes, the demand for plasma has fallen; NPD DisplaySearch expects this to continue and has reduced its forecast for plasma TV.

Large TV sizes also continue to show strong growth, with shipments of 40”+ and larger sets expected to grow 12% in 2012 while larger than 40” sizes decline 3%. A strong contributing factor to the growth of larger sizes, including an 18% increase in shipments of 50”+ sets, is pricing. Sizes up to 50” will have average prices below $1000 in 2012 and even 60” + sizes will fall below $2000 for the first time. During Black Friday holiday sales in the US, many 40-47” sets were below $500, and even 60” sets fell below $1000, prompting robust unit sales as consumers were attracted to the new price points. Many consumers seem to be willing to give up features in favor of larger sizes for a given TV buying budget. Even in China, shipment share of 50” + and larger sizes is growing strongly and may become the only region outside of North America to reach 10% 50”+ mix of unit shipments by 2015.

2.6 Million 4K Ultra HD TVs to Ship in 2013

Still wondering and worrying that 4K (Ultra HD) isn’t going to take off? Check out NPD DisplaySearch‘s latest numbers. The firm just released its latest Quarterly Large Area TFT Panel Shipment Report, which says a whopping 2.6 million 4Kx2K LCD TV panels will ship by the end of 2013. This means the technology, also known as Ultra HD, will grow 40-fold. After all, 2012’s numbers were somewhere around 63,000.

According to the report, TFT LCD panel suppliers will play a pivotal role in 4K×2K LCD TV adoption, via cost-effective solutions and new technologies. NPD DisplaySearch specifically mentions high-transmittance cell designs, high-output driver integrated circuits (ICs), and high-efficiency backlight units and integrated up-scaling circuits for 4K×2K panels.

“To date, Innolux Corp. has been the most aggressive panel manufacturer in this market segment, developing a full line-up of 4K×2K panels in the 39- to 85-inch range,” says David Hsieh, VP of NPD DisplaySearch’s Greater China Market. “Despite this, 4K×2K panel manufacturers’ shipments are primarily focused on 50-, 55/58-, and 65-inch sizes, which are expected to have the highest volume shipments, especially in China.”

Of course, the above data doesn’t necessarily mean everyone is going to rush out and build a home theater around a 4K display. That would be nice, but it seems like these numbers are factoring in the commercial market, which includes digital signage. In fact, panel manufacturers are hoping to strengthen relationships with any and all LCD TV brands, to bring the tech to the masses.

“4K×2K LCD TV is the newest TV technology available, and in order for it to be successful, it will be critical for the supply chain to avoid falling behind when making their purchases, even if content is still scarce,” adds Hsieh. “Some panel makers are also working with design houses to develop circuits built into the panel, to enable up-scaling of HD to 4K×2K content. This will help to drive the 4K×2K LCD TV market and encourage panel makers, especially those that have already started design-in work with TV brands in 2013.”

打造Social TV生態系 Smart TV三大陣營成形

Smart TV雖仍處於起步階段,但2011至2012年的出貨量成長數字預計將十分驚人,而2011年由智慧行動終端所掀起的科技產業典範轉移,終究有一天亦將蔓延到TV。根據拓墣產業研究所預測顯示,全球Smart TV出貨量將有機會從2010年的704萬台成長到2011年的2,518萬台,佔整體TV比重的10.4%;隨著更多TV品牌業者推出新款Smart TV,2012年全球Smart TV出貨量可望增加至5,285萬台,年成長逾100%,佔整體TV比重20%。拓墣產業研究所張乘維經理表示,後PC時代,消費電子產品將持續進化,Smart TV將是最終戰場,其中使用者介面、遊戲、網路瀏覽器、OTT Video、社交網路、搜尋工具等為Smart TV六大關鍵成功要素,殺手級應用則非社交網路莫屬。

TV+Social Smart TV搶攻新世代

拓墣表示,社交網路既然可以進入行動裝置市場,當然也可進入電視市場。觀察各大品牌業者所推出的Smart TV產品,顯示「社群」與「分享」已成為Smart TV的兩大核心要素,包括Samsung、Sony、LG、Sharp、Philips等廠商都在最新的Smart TV中增加了Facebook、Twitter、Google Talk、Skype等社交網站的應用程式。而看電視本來就是社交的一環,譬如美國2011年2月超級盃足球賽期間,每秒產生4,064則Tweets,美國四大電視網ABC、NBC、CBS、FOX也開始針對社交媒體推出各類型節目或服務。

拓墣指出,Smart TV的殺手級應用,應當屬社交功能的出現,讓Smart TV的概念從過去建立在TV導向提供OTT/VoD服務、串流影視、實境秀、Flash影視、TV Apps、3D影視等內容,逐漸趨向社交網路導向的型式發展,吸納更多使用者、影片、社交媒體桌面工具匯集,並融合各種裝置和應用程式集大成。拓墣強調,Social TV應該包含Smart TV、平板機、智慧手機等智慧裝置,和直播電視等影音內容,以及社群軟體,共同打造以社交為中心的生態環境,唯有貫徹Social概念,才能整合TV和Web,催生符合新世代年輕消費者需求的Smart TV,以求產品爆量增長。

三大陣營成形 比拼內容質量

社交網路導向的Smart TV產品誕生之後,作業系統平台將驅動Smart TV陣營成形,陣營內各自共享平台上的應用程式內容。以目前趨勢來看,拓墣表示目前擁有近千個應用程式以及1,000萬次下載量的Samsung Smart TV,將自成一大陣營;Sony、Vizio,以及中國大陸彩電品牌海信、TCL與康佳將加入Google Android平台;LG、Sharp、Philips三家廠商則以HTML5、CE-HTML和HbbTV等開發語言為基礎,共同打造Smart TV的軟體開發工具。TV品牌業者除了將研發能量集中開發應用程式之外,影音內容質量則是另一決勝關鍵。

分析

- 2012 Smart TV 出貨量大幅成長 109%,2013 Smart TV 出貨量大幅成長 66.28%;

- Apple Smart iTV 一出現,將搶走 15% ~ 20% smart TV 市場,也就是 iPod、iPhone、iPad 使用者市場,這是無可避免的;

- 預估 Apple Smart iTV 最快 2013 年底出現;