美國太陽能租賃龍頭 SolarCity 於 8 月 7 日公布 2014 年第二季財報,已裝設的太陽能板總發電量在第二季提升到 218 MW,遽增 216%,且光第二季單季就增加了 3 萬名客戶。

2012 年第一季時,SolarCity 裝設一組太陽能發電系統平均每瓦成本為 3. 16 美元,2014 年第一季已大幅跌落至 2.46 美元,第二季只剩 2.29 美元,成本下跌速度相當快,營運長 Tanguy Serra 更表示,成本降低速度為預期目標的兩倍之多。

此外,SolarCity 最近剛併購高效太陽能電池與模組製造商 Silevo,有了自己的完整產業鏈,將更能有效降低成本,因此 SolarCity 大膽預估 2017 年將達成每瓦 1.9 美元的低安裝成本。

至於SolarCity 即將發行的第三次資產債券,金額將提升至 2 億 100 萬美元,標準普爾(S&P)信用評級則為BBB+。儘管第二季太陽能板安裝量暴增,但 SolarCity 保守預估第三季安裝量會稍微下滑在 135 到 150 MW 間;2014 年整年安裝量約為 500 到 550 MW;至於 2015 年,則樂觀預估會達到 900 至 1,000 MW。

SolarCity 目前太陽能板安裝數量的成長與需求已遠遠超乎預期,持續穩座太陽能租賃龍頭。SolarCity 樂觀預估在接下來 20 年內,公司營收可望超過 33 億美元。

SolarCity Downgraded On Escalating Stock, Competition

SolarCity got a downgrade Tuesday because of its escalating stock price and the increasing competition from rivals, including a company expected to launch an initial public offering soon. That's the assessment from Ben Kallo, an analyst for Robert W. Baird, in a research report released Tuesday. He cut his rating on SolarCity (NASDAQ:SCTY) stock to neutral from outperform, but he kept his 83 price target.

SolarCity stock was down 2.5% in early afternoon trading in the stock market today, near 70.25. But SolarCity stock is up 24% for the year.

In his report, Kallo said that although SolarCity is the leader in the accelerating U.S. residential market for solar products, the company's stock price might have gotten a bit ahead of itself. And he cites rising competition with SunPower (NASDAQ:SPWR), First Solar (NASDAQ:FSLR) and Vivint, which is reportedly working on an IPO. SolarCity recently announced plans to manufacture its own solar panels.

"We believe SolarCity's move into high-efficiency panel manufacturing introduces scale-up risk ... . SunPower has over a decade of experience in manufacturing high-efficiency solar panels and has allocated 2.5-plus years to construct and ramp its Fab 4 (about 350 megawatt) manufacturing line," he wrote. "Although SolarCity has considerable future earnings and cash-flow generation capabilities, we believe SunPower and First Solar are currently best positioned, given their manufacturing capabilities, international presence and positive earnings." SolarCity this month reported rising losses and lower-than-expected Q2 revenue.

DE Penetration Lowers the Value of Traditional Generation ( 美國分散式太陽能成長讓傳統發電廠價值下降 )

DE may also be a harbinger for a broader type of deconstruction that is affecting the power value chain. Integrated utilities provide bundled services: energy generation, transmission, grid services (such as power reserve and stabilization), demand response management, distribution, metering, and customer service. When a non-utility third-party cherry picks the value chain and provides specific services at a lower price, the traditional rate design no longer matches costs and revenues. New entrants have a growing stake in generation through distributed products, but they also derive benefits from services such as demand response management and energy storage. Over time, the power value chain could change dramatically.

|

| 美國分散式太陽能成長大增,讓傳統發電廠收入大幅下降,大幅降低尖峰用電量 |

The utilities’ business model is about investing capital and capturing returns. As DE penetration increases, capital shifts from areas that utilities have traditionally controlled to areas in which they are not involved.

|

| solar power generation to off the peak power consumption of city |

What’s more, as large investors turn their attention to the emerging DE industry, traditional utilities are beginning to lose their advantage in terms of low cost of capital. For example, we estimate that when a major solar installer and developer securitized its solar leases last year, the company’s cost of capital dropped to a level that was 200 to 300 basis points lower than most regulated utilities’ cost of capital.

With microgrid technology, DE has the potential to enable areas such as subdivisions, cities, and counties to form “islands” that either exist off the grid entirely or depend on it only for backup generation. DE could, therefore, turn the existing infrastructure of transmission lines and power plants designed to serve those areas into stranded assets.

Finally, utilities’ regulatory edge is eroding as DE companies gain leverage through regulatory management teams that represent a growing number of individual consumers. Taken as a whole, these changes are turning the odds against the traditional utility model.

蓋電廠 不如削減夏季用電尖峰

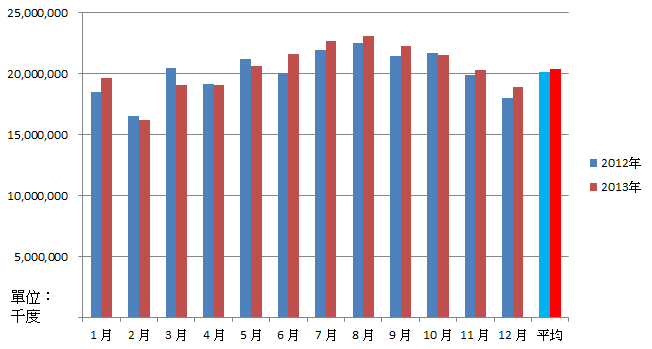

夏季炎熱,人要消暑,工廠的生產線與馬達也要通風散熱或吹冷氣以維持效率,這使得台灣的夏季出現了用電尖峰。2013 年 8 月份的用電量,就比 12 月份還要多 41 億度電。

|

| 2012與2013年每月用電度數曲線。(資料出自能源局能源統計月報) |

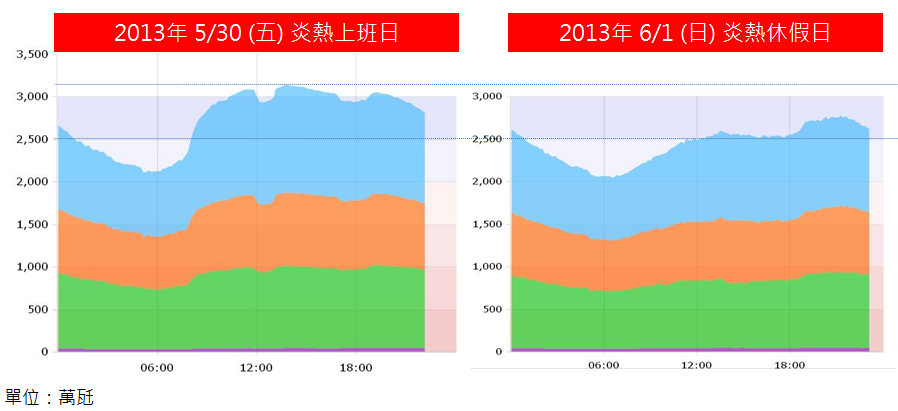

從上面這張圖,夏季每日用電曲線來看,用電尖峰是在上班日的下午 2-3 點左右,大約在 3,200 萬瓩。接著是午飯前 11 點半,第三高峰是晚間 7-8 點。到了大部分工廠停工的週日,則僅剩晚上的用電高峰,並且比上班日少了 600 萬瓩以上。造成這三個高峰的原因很多,餐飲業準備膳食、上午 11 點開始營業的大型零售業、工廠生產線作業啟動,以及民眾回家後打開照明與視聽設備。

再隨機選擇夏日與冬季各一個普通上班日來觀察。冬季上班日的用電尖峰是在下班時刻的晚上 6 點,冬季下午 2 點峰值不明顯,與夏日同一時間大約少了 7-800 萬瓩。

|

| ▲ 夏季上班日與周日用電曲線比較。(擷取自台電每日用電資訊) |

|

| ▲ 夏季與冬季上班日用電曲線比較。(擷取自台電每日用電資訊) |

也就因為這樣,我們為了應付夏季用電尖峰的那幾天的那幾個小時,而準備了這麼多發電廠機組。到了非夏季時,就有許多機組閒置,徒增維護經費,核電廠與大型火力電廠機組則趁著冬季輪流排歲修;雖然知道「養兵千日,用在一時」,然而「養兵」也是要錢的。

因此,只要想辦法削減「夏季尖峰負載」的用電量與時數,或至少讓它不要成長,便可以短期間內減緩台電新建電廠的壓力。爭取下來的時間與省下的電廠興建成本,則可以再拿去積極投資節電策略與發展再生能源,或強化台灣電力系統的調度能力,真正舒緩長期的用電需求。

削減「夏季尖峰負載」的方式其實有很多,有些是台電已實施您也很孰悉的手段,有些未實施的,門檻也不高,以下列舉幾個方式,希望能激發您對電力的更多想像。 ... 持續閱讀

太陽能分散式發電分析

- 由美國、澳洲太陽能分散式發電發展看,主要是

- 政府立法鼓勵金融業提供相關類似高息商品給太陽能分散式發電公司共同以承租方式長期收取用戶費用,用戶也節約部份電費又不用買整套太陽能分散式發電系統;

- 金融業獲得高息商品之利潤,營業上升獲利成長;

- 用戶也節約部份電費又不用買整套太陽能分散式發電系統,同時又得到智惠型電力管理系統,隨時可以由電腦或智惠型手機了解電力狀況,房屋價值也因此升高;

- Distributed energy (DE) technologies have grown significantly in the U.S. Last year, DE represented one of the largest investments in the utilities space, and that investment, along with consequent growth, is likely to accelerate. From 2010 to 2013, DE accounted for about 21 percent of all new capacity in the nation. The number of commercial and residential rooftop solar installations, for example, increased by 22 percent in 2013. The increase comprised about 1.9 gigawatts and represented roughly $8 billion in investments.

- 我國冬季用電少,夏季用電多,這是因為我國地處亞熱帶,夏日冷氣用電需求高的緣故。尖峰用電在白天,夏季白天冷氣用電需求高,因為營業公司都開冷氣及照明,用電尖峰及離峰甚致高出 48% 電力:

- 夏季每日用電曲線來看,用電尖峰是在上班日的下午 2-3 點左右,大約在 3,200 萬瓩。

- 夏季每日用電曲線來看,用電離峰是在上班日的早上 4-6 點左右,大約在 2,200 萬瓩。 尖峰與離峰平均差到 30% ~ 35% 電力;

- 而太陽能發電補尖峰用電至少是最經濟又可延緩核四運轉,讓科技與時間說出該走的路,依太陽能發展的速度,一片同樣面積太陽板很快將達到 365W、每瓦 0.25 美元,一般家庭需要之白天電力很易被家庭式太陽能發電代替,因此,很容易捕台電尖峰電力不足,核能就能逐漸轉成封存備用;

- 若LED照明及電器節能配套策略與企業強制之法令,可延緩核四運轉之年限可拉長至6年,其他能源效能也會再提高,有利於台灣做出最有利於台灣決定;

- 台灣目前最大問題就是,馬政府之國營到處漲價壓榨人民生計,真正該做的照明及電器節能配套策略根本不積極,台電對於節能策略也不夠積極,節能是一個產業;

- 目前太陽能電池效率與成本:

- 德國有機太陽能電池效率已經到達 44.7%,如 SunPower 太陽能電池板大小可產生 717 W,每瓦可降至 0.5 美元,都市白天都將被太陽能分散式發電系統取代,將少掉 1000 萬瓩,也就是說台灣核能都可以封存,減少能源進口 GDP反而成長;

- SunPower 太陽能電池可將21.5%的太陽能轉換成電力,太陽能電池板大小 155.9 x 104.6 cm ,可產生 345W,每瓦 0.6 ~ 0.5 美元;

- NSP 台灣新日光太陽能電池可將15.6%的太陽能轉換成電力,每瓦 0.5 ~ 0.3 美元;

- 大陸 Jinko 太陽能電池之太陽能轉換成電力 16.5%,每瓦 0.5 ~ 0.3 美元;

- 預估未來幾年內, 太陽能電池將降至每瓦 0.3 ~ 0.22 美元;

- 太陽能投資與成本計算實例,投資成本最貴是儲能系統,只補尖峰用電量投資成本最低,但政府並沒有一套配套策略,以致台灣難發展成功;( 註:德國太陽能發電量已經是 23.1 GW 約總需求量之 50.5% ,但仍需足夠支儲能系統將它儲存才能完全使用,否則,仍是白天補電效益;)

沒有留言:

張貼留言