It aims to revitalize Ultrabooks while also moving further into mobile

英特爾(NASDAQ: INTC )第四季度盈利報告強調了它所面臨的挑戰,以及在其核心業務的難打入蓬勃發展的移動市場。Intel 產品遲於一方佔主導地位的ARM(納斯達克股票代碼:ARMH),高通( NASDAQ : QCOM )今天宣布,NVIDIA公司(Nasdaq代碼:NVDA)及三星等,使這項工作更加艱難。盈利報告中顯示,本季度的淨收入為2.5億美元(從$3.4十億在同一季度上一年度),...,以高科技的移動轉型。Intel‘s (NASDAQ:INTC) fourth-quarter earnings report highlighted the challenges it faces in its core business as well as the difficulty of breaking into the booming mobile market. Coming late to a party dominated by ARM (NASDAQ:ARMH), Qualcomm (NASDAQ:QCOM), Nvidia (NASDAQ:NVDA), Samsung and others makes that job much tougher. The earnings report, which showed net income for the quarter at $2.5 billion (down from $3.4 billion in the same quarter the previous year), and the resignation late last year of CEO Paul Otellini underscore the impact of being so slow to react to tech’s mobile transformation.

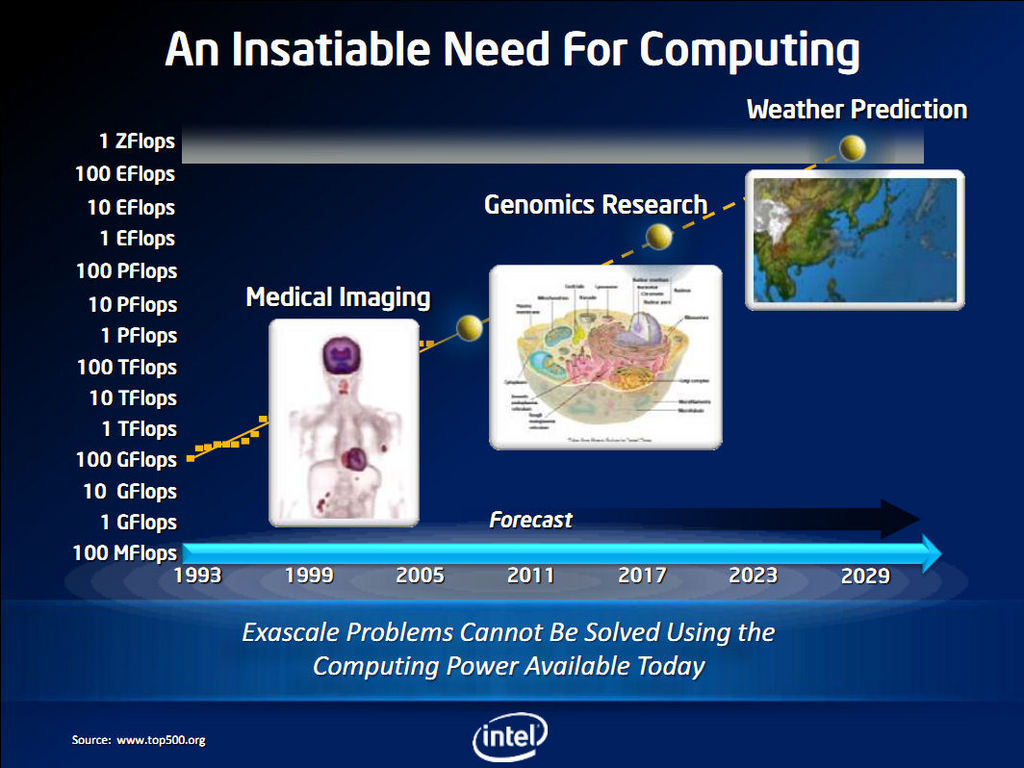

At this year’s Consumer Electronics Show, Intel laid out plans for its next-generation computer chips (code named Haswell) and its PC roadmap through 2014. And while you may wonder what PCs have to do with Intel’s mobile problem, if things go according to Intel’s plan, the two could actually be convergent — at least in the tablet market, which is currently seen as the big threat to computers.

My Favorite Tobacco Stock Is … Intel?

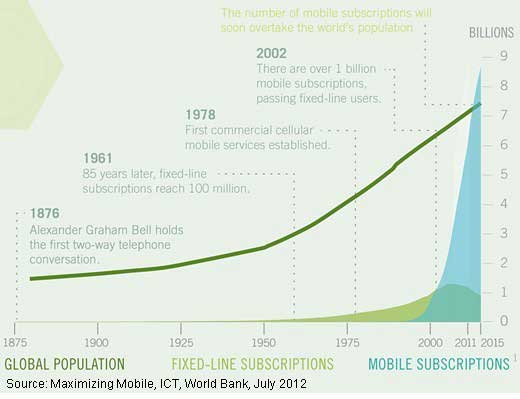

事實上,平板電腦是英特爾的頭號敵人。平板電腦可能有很多的限制,作為一種商業工具(他們缺乏鍵盤,它們不運行的最流行的應用軟件,他們有一個小顯示屏),但它們更便宜,更便攜,並正在搶購的消費者和業務。像蘋果公司(NASDAQ:AAPL)的iPad平板電腦是PC銷售放緩的一個重要組成部分。Indeed, tablets are Intel’s enemy No. 1 at the moment. They may have many limitations as a business tool (they lack physical keyboards, they don’t run the most popular software applications and they have a small display), but they’re cheaper, much more portable and are being snapped up by consumers and businesses. Tablets like Apple’s (NASDAQ:AAPL) iPad are a big part of the slowdown in PC sales.

When Apple launched the MacBook Air in 2008, not many in the Windows PC camp considered it much of a threat. Although the ultraportable notebook was incredibly small and light (for the time), it was underpowered, jettisoned components like an optical drive, wasn’t upgradable and started at $1,799. Apple didn’t give up and relentlessly improved the MacBook Air, expanding the lineup to include multiple models. Sales took off.

英特爾回應,其2011年的Ultrabook的主動,旨在讓PC製造商好好地對抗蘋果。是的,英特爾還提供了CPU及那些MacBook架構,但芯片製造商有既得利益在Windows個人電腦的競爭力。新的Intel Ivy Bridge處理器,於2012年年底,Windows的Ultrabooks預計將佔消費筆記本電腦銷量的40%。Intel responded with its 2011 Ultrabook initiative, designed to allow PC manufacturers to better compete against Apple. Yes, Intel also supplied the CPUs in those MacBook Airs, but the chipmaker has a vested interest in keeping Windows PCs competitive. With new Intel Ivy Bridge processors, Windows-based Ultrabooks were expected to account for 40% of consumer laptop sales by the end of 2012.

英特爾財報利空 外資:平板護身 概念股免驚

英特爾財報利空雖然凸顯今年PC產業年關仍難過,但身為英特爾概念股的華碩,卻因成功跨足平板電腦上周五股價逆勢大漲。港商里昂證券等外資法人指出,只要有平板電腦題材護身,未來與英特爾股價波動的關聯性就會降低!

巴克萊資本證券亞太區下游硬體製造產業首席分析師楊應超指出,英特爾去年第四季營收135億美元與市場預估值吻合、每股獲利0.48美元則優於市場預估的0.45美元;至於今年第一季營運展望,營收127億美元、低於市場預估值129億美元,且連續3季展望低於市場預期。

楊應超認為,英特爾第一季營收約較第四季下滑 6%,與亞太區供應鏈的看法差不多,也符合季節性因素,只是單純解讀上述營運展望,似乎已透露出PC需求短期內不會好轉的訊息,因此亞太區下游PC供應鏈族群短線仍不宜樂觀。

至於下半年PC景氣,楊應超認為,靜待新處理器 Haswell 拉貨需求、Win8功能漸為消費者熟知、觸控NB普及率拉高且價格調降後能否帶來旺季需求,現在看來應有起碼的旺季效應。

儘管英特爾財測數據看來索然無味,還是有2項訊息值得討論:一是今年資本支出達130億美元、較去年大幅成長18%;二是對數據中心看法非常樂觀,營收重回2位數成長。

摩根大通證券科技產業分析師哈戈谷(Gokul Hariharan)指出,英特爾大舉擴增今年資本支出至130億美元,主要用在投資18吋晶圓,市場解讀會對台積電晶圓代工霸業構成威脅,但摩根大通證券半導體分析師徐禕成認為,除非英特爾有拉低整體毛利率打算,否則短期內很難影響台積電。

至於英特爾看好的數據中心成長力道,如先前花旗環球證券預估,雲端運算強勁需求未來3年將帶動雲端伺服器產業以每年18%速度成長,廣達、緯創、台達電、川湖等個股可望受惠。

而英特爾概念股華碩上週五逆勢大漲,根據港商里昂證券了解,華碩近期美國與亞太地區的NB市佔率都有攀升跡象,今年在出貨成長率達8%、以及ASP拉高(小筆電比重下降)的帶動下,NB營收成長率可望達11%,加上第一季底將推出新款平板電腦,短線都有利於股價表現。

分析

- Intel 的 Transform computing 是對的,但由於功耗、晶片價格、3G & 4G 晶片技術都遠不如 ARM 陣營,加上 Tablet 走低價風,Ultrabook 及 PC 產業都下降,還好是每股獲利優於市場預估;

- 2013 年Intel 的市場占有率仍下降,獲利是否持續優於市場預估就不得而知;我預估只要 UltraBook、PC及伺服器仍被 Intel 占有,且Apple Mac 未轉單至 ARM,Intel 的獲利不會轉差。

- 2013 Ultrabook 仍是維繫 PC 產業關鍵,台廠須思考 Ultrabook 及 Super Tablet 兩用一體的機種,以平價方式出產,應該能微幅振興PC 產業;