而大泡沫延伸之資金行情、通貨膨脹/景氣行情、貨幣危機來的如此快,資金行情已經跑到連一般投資人都開始懷疑: 怎麼會漲成這樣?由其是非美區域性之股票,最大災難最大泡沫隱含最大風險與最大利潤,為什麼國際資金持續拉升非美區域性之股票?

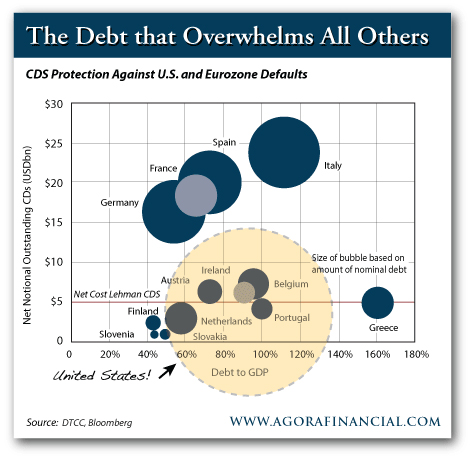

- 由以下美公債時辰表不難發現美國將持續發債,國際資金當然要分散風險將資金轉成其他貨幣資產;

- 資金進駐非美區域性之股票與貨幣,在等待下一波美債突增之戰略,反正,已經逐步將非美區域性之資產拉高;( Funds stationed in non-US regional stocks and currencies, waiting for the next wave of U.S. debt surges from strategy, anyway, has been gradually non-US regional assets pulled; )

- 是否等待時機大量資金再進入商品造成通貨膨脹,還未必全面看見它們會這樣做,但是它們逐步讓美元轉弱之方向是確認的;( Whether waiting for an opportunity to a lot of money re-entry of goods causes inflation, may not be fully seen them do so, but they gradually so that the direction of a weaker U.S. dollar is recognized; )

- 資金進駐非美區域性之股票與貨幣,但非美區域性之 GDP 成長則下降,一旦,美元升息弱勢GDP之非美區域將產生災難性金融風暴。( when money stationed in non-US regional stock and currency funds, once, non-US regional's GDP growth fell, the dollar rate hike vulnerable non-US regional GDP will have disastrous financial turmoil. )