影子銀行又稱為影子金融體系或者影子銀行系統(Shadow Banking system),是指銀行貸款被加工成有價證券,交易到資本市場,房地產業傳統上由銀行系統承擔的融資功能逐漸被投資所替代,屬於銀行的證券化活動。影子銀行系統的概念由美國太平洋投資管理公司執行董事麥卡利首次提出並被廣泛採用,又稱為平行銀行系統 (The Parallel Banking System),它包括投資銀行、對沖基金、貨幣市場基金、債券保險公司、結構性投資工具( SIVs )等非銀行金融機構。這些機構通常從事放款,也接受抵押,是通過杠桿操作持有大量證券、債券和複雜金融工具的金融機構。在帶來金融市場繁榮的同時,影子銀行的快速發展和高杠桿操作給整個金融體系帶來了巨大的脆弱性,併成為全球金融危機的主要推手。

目前,影子銀行系統正在去杠桿化的過程中持續萎縮,然而,作為金融市場上的重要一環,影子銀行系統並不會就此消亡,而是逐步走出監管的真空地帶,在新的、更加嚴格的監管環境下發展。未來,對影子銀行系統的信息披露和適度的資本要求將是金融監管改進的重要內容。目前,美國已提出要求所有達到一定規模的對沖基金、私募機構和風險資本基金實行註冊,並對投資者和交易對手披露部分信息。

中國信託資產創兩年最慢增速,信託業管理的信託資產總規模為12.48萬億元人民幣

截至6月30日,信託業管理的信託資產總規模為12.48萬億元人民幣(2萬億美元),季度環比成長6.4%。隨著中國政府打擊影子銀行,投資者重新評估信託這一高殖利率投資的風險,中國信託資產創下兩年來的最慢增速。

中國信託業協會昨日在一份公告中表示,截至6月30日,信託業管理的信託資產總規模為12.48萬億元人民幣(2萬億美元),季度環比成長6.4%。 這是2012年第一季度以來的最慢增速,遠低於2008年以來的平均年增幅50%。

中國影子銀行從2010年開始出現爆炸式成長,眼下國務院總理李克強正在 努力維持經濟成長並抑制金融系統的風險。海通國際證券經濟學家胡一帆在7月25日的研究報告中指出,信託行業的「清算日」(day of reckoning)即將到來,中國信託產品本季度和下季度將迎來償付高峰期, 銀行將不得不吸收信託產品違約造成的大量損失。

中信建投駐北京分析師曾羽今天接受電話採訪時表示,監管機構、銀行和 地方政府都在努力控制信託風險,但是只有經濟提速成長,借款人重新站穩腳跟的時候,這個行業的狀況才會真正好轉。曾羽說,中國投資者變得更加厭惡風險,越來越來的投資者將選擇殖利率較低、風險較低的產品。

|

| 中國大陸總負債 2012 達到GDP 277%, 到達 2014 就會超越德國, 預估到 2016 極可能與義大利一樣成為高負債國 |

6月末,信託業管理的信託資產總規模比5月末下降2400億元。公告稱這是首次出現月度負成長。中國信託業協會表示,第二季度信託產品的平均殖利率從第一季度的6.44%升至6.87%。

收緊政策

中國1月份避免了首例信託產品違約,當時中誠信託發行的30億元高殖利率產品到期前幾天,購買這款產品的投資者得到兌付。該公司上個月推遲了對另一款產品的償付。

從煤礦企業到房地產開發商的借款人出現兌付困難後,中國銀監會4月份收緊了對新信託產品的規定。李克強希望通過增加銀行貸款、抑制成本更高的影子融資來降低企業的借貸成本,進而扶持企業發展,支持經濟成長。

公告顯示,截止2014年6月末存續的12.48萬億元信託資產中,來源於各類金融機構自有資金的投資占比35.26%;來源於以各類金融機構為主體的理財資金的投資占比33.89%;剩余的來自最低投資額為100萬的普通合格投資者。

房地產風險

曾羽說,上半年很多產品出現問題,監管機構對風險發出預警之後,信託公司承受著改善風險控制的壓力,因此他們不得不放緩新產品的發行步伐。而且,過去幾年的增速根本不可持續。

中國信託業協會表示,資金信託投向工商企業和基礎產業占比約為50%, 投向房地產占比為11%。該協會表示,隨著房地產行業風險上升,資金信託投向房地產領域將更為謹慎。

該協會的報告顯示,全國68家信託公司的所有者權益總額約為2750億元, 這凸顯出它們為自己的產品承擔隱性擔保的能力有限。... 持續閱讀.

Why The Downside To The Fed's "All In" Attempt To Spike Shadow Monetary Velocity Is A $4.5 Trillion Drop In GDP

It appears that the one topic pundits have the most problems grasping is the spread between the GDP. A summary which confirms just how prevalent the confusion is, is this terrific post by the Calafia Beach Pundit, terrific not because it is even remotely correct (the post is so blatantly wrong - one wonders if Western Asset Management even expects its current and former asset managers to count beyond 2... M2 that is), but because it demonstrates how self-professed "pundits", whether of the beach variety or not, don't have the faintest grasp of more than merely trivial monetary topics.

segregation of traditional and shadow monetary aggregates, overall economic deleveraging and aggregate monetary velocity, and how all that impacts

The basis for the above-mentioned post's argument is that since M2 is growing (which it is for 16 weeks in a row now as we have been pointing out repeatedly), and since M2 velocity has performed a dead cat bounce off its 30 year lows following the complete collapse in M2 velocity after the bankruptcy of Lehman, that GDP has to grow. Period. This argument is so flawed and so one-sided, that its refutation and subsequent elaboration as to what reality truly is, is what this post was at first all about. Yet in refuting the simplistic conclusion of a mainstream pundit's myopic perspective, we uncover something far more troubling: namely that should the Fed fail in stoking consolidated aggregate monetary velocity very quickly, as the shadow liability collapse accelerates, US GDP has the potential to drop by up to $4.5 trillion over the next 3 years.

First, looking at M2, it is indeed the case that M2 has been growing. As the chart below shows, since the beginning of 2010, M2 has grown by $288.7 billion from $8485 to $8773 billion.

The problem, as Zero Hedge readers know all too well, is that M2 is merely a small subcomponent of all practical monetary aggregates, including those derived from the shadow credit system. As the beach pundit certainly should be aware, a far more important aggregate is M3, which the Fed has conveniently decided to eliminate, just so those of the permabullish persuasion can spin factless arguments using the far more easily manipulable M2 as a proxy for money demand. And looking beyond M2 is precisely where the entire argument falls flat on its face.

Since the bulk of credit and monetary growth over the past 30 years has occurred not at the observable M2 level, but at the level of shadow banking liabilities (from $620 billion in 1980 to $21.4 trillion at the peak in Q1 2008), and their monetary representation (be it M3, or our broader custom aggregation), a far more indicative view of GDP as a product of monetary aggregate velocity is that of GDP not to M2, but of GDP to M2 and Shadow Banking, which includes in addition to the generic M2 components such as M1 (currency, demand deposits), and retail money funds, savings deposits, and a variety of other deposits, also such shadow components as money market mutual funds, GSE capital, ABS issuers, repo money, open market paper, and agency and mortgage pools. The combination of all that is the most definitive and comprehensive representation of money demand available for the US economy.

The chart below shows just how much more of a factor the shadow economy has become of the past 30 years. While in 1980 the ratio of M2 to Shadow banking monetary aggregates was 135%, the resultant surge in shadow debt, and thus shadow money, as a result of 30 years of declining interest rates, led to a M2/Shadow ratio of under 50% in 2008 (black line in chart below).

A complete and valid representation of aggregate monetary velocity has to take all these excess components: anything else is an insult to the intelligence of one's, in this case, readers. Which is where a far more different picture than that presented by some pundit or another emerges.

Note that in the chart below, as credit has become easier to procure, and increasingly cheaper since the arrival of the Maestro, and as cheap credit-derived money flooded the system, the overall broad money velocity (M2 and Shadow Banking monetary equivalents) has collapsed, even as GDP has been growing. In other words, as more and more credit has gotten added to the system over the past three decades, such new credit has had a progressively smaller impact on true economic growth. And here is the key point that makes a mockery out of the abovementioned "analysis" - even as M2 has grown by under $300 billion, courtesy of QE 1 and QE Lite, shadow banking liabilities and appropriate aggregates have plunged by $2.1 trillion in just the first six months of 2010! Let's see: +$300 billion compared to -$2.1 trillion. Hmmm.

Let's recall that the prevailing theme of the ongoing depression is deleveraging: at the consumer and at the corporate level (courtesy of sovereign leveraging, and $13.7 trillion in federal debt compared to under $9 trillion three years ago, which makes the cost of deleveraging next to nothing), the current collapse in Shadow liabilities, and associated monetary aggregates will persist for a long, long time. Keep in mind the Fed has little control over this, and this is what most pundits (no matter how self-proclaimed) get teribly confused by. All that the Fed can do is hope to increase the velocity of the corresponding circulation of M2, and beyond, money.

Which is where things get really ugly.

Contrary to the beach pundit's conclusion that the growth in M2 most certainly portends a pick up in GDP, we present the completely opposite case: namely that the collapse of shadow credit, and the resultant elimination of shadow money, could result in a plunge in US GDP as high as $4.5 trillion over the next 3 years. And what most don't understand (but Blackhawk Ben most certainly does) is that what M2 does over this period is completely irrelevant as shadow deleveraing will be the far more dominant force vis-a-vis GDP.

And what the Fed is trying to do, more so than anything, is to return the M2+Shadow Banking velocity back to traditional levels, far higher from the current 58%. That the Fed has succeeded in raising it by 8% from its all time low 2 years ago, is purely a function of Quantitative Easing. The real question is whether QE2 will have the same success in stoking at least some consolidated velocity and its resultant GDP pick up.

影子銀行系統累積的金融風險

影子銀行雖然是非銀行機構,但是又確實在發揮著事實上的銀行功能。它們為次級貸款者和市場富餘資金搭建了橋梁,成為次級貸款者融資的主要中間媒介。影子銀行通過在金融市場發行各種複雜的金融衍生產品,大規模地擴張其負債和資產業務。所有影子銀行相互作用,便形成了彼此之間具有信用和派生關係的影子銀行系統。

影子銀行的基本特點可以歸納為以下三個。其一,交易模式採用批發形式,有別於商業銀行的零售模式。其二,進行不透明的場外交易。影子銀行的產品結構設計非常複雜,而且鮮有公開的、可以披露的信息。這些金融衍生品交易大都在櫃臺交易市場進行,信息披露制度很不完善。其三,杠桿率非常高。由於沒有商業銀行那樣豐厚的資本金,影子銀行大量利用財務杠桿舉債經營。

在過去20年中,伴隨著美國經濟的不斷增長,人們對於信貸的需求與日俱增,美國的影子銀行也相應地迅猛發展,並與商業銀行一起成為金融體系中重要的參與主體。影子銀行的發展壯大,使得美國和全球金融體系的結構發生了根本性變化,傳統銀行體系的作用不斷下降。影子銀行比傳統銀行增長更加快速,並游離於現有的監管體系之外,同時也在最後貸款人的保護傘之外,累積了相當大的金融風險。

分析

- 全球貨幣寬鬆程度過去只用 M1B、M2,自從影子銀行壯大後,影子銀行比傳統銀行增長更加快速,美國和全球金融體系的結構發生了根本性變化,全球貨幣供應需改成影子銀行創造之貨幣供應量+M2,所以全球貨幣寬鬆程度已經是由債延伸之商品在加速;

- 因此當美元升息時,垃圾債泡沫就易破滅,全球經濟隨時受影子銀行風險產生影響;

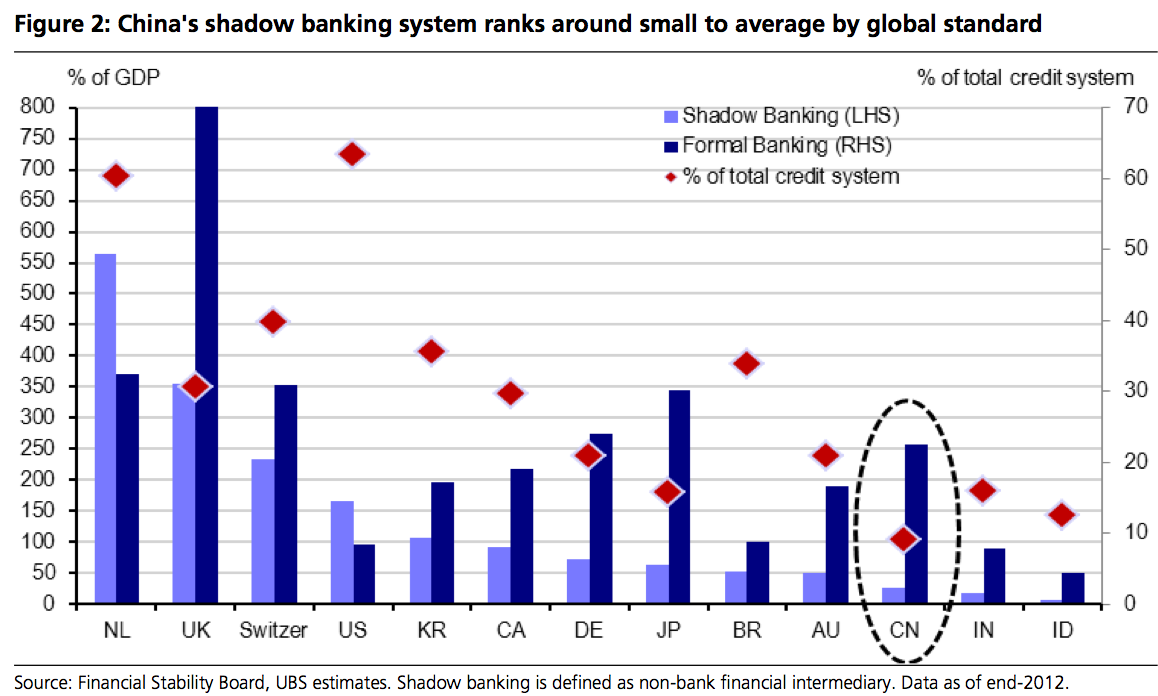

- 若中國不降低利率讓企業介由正常銀行體系借出資金同時促進內需消費,這情況對中國大陸反而更危險,因為一推企業借債製造『產能過剩泡沫』就如同地方房地產債一樣也是『過剩泡沫』現象,中國大陸經濟問題是利率過高內需消費不足;