新台幣一夕狂升,雖有熱錢回流的利多護住多頭心脈,但憂心匯損買盤仍忙不迭的往資產、航空、食品等內需股湧去,上周五獲外資241億元買超、率先回補川普缺口的台積電回神無力,以956元、上漲6元開出後沒多久就翻黑,拖累以20,839.04點跳空開高、上漲51.4點的加權指數,也跟進走弱,一度跌點擴大至逾百點,多空交戰激烈。

這次台幣急升且升幅全球最高,M1B 是衰退,外銷股是不好,內需股比較優,台幣對美元急升後再緩升至28是最佳。航運股最佳機會在美國關稅戰後出現缺貨潮拉急單時。

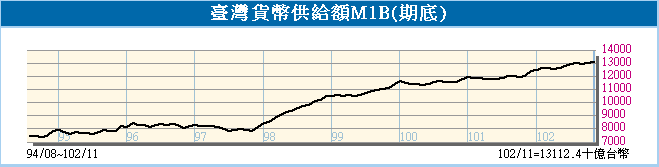

看看歷史就知道,差異在那裡。

|

| 2882 K chart |

2013, 12, M1B, M2是增漲,台幣是緩漲,所以漲幅週期是 漲8個月,回跌1個月,再漲5個月

2025 臺灣貨幣供給額M1B(期底) 2025/3 278,000億 -2010.3億

臺灣貨幣供給額M2(期底) 2025/3 649,220億 -96.4億

臺灣景氣對策分數 2025/3 34 -3

只有內需股有行情,所有外銷股,特別是買太多美債公司將產生很大虧損,航運股觀察低點及美國缺貨潮拉急貨時。

台灣央行甫公布11月台灣M1B、M2年增率持續加速,已連續14個月的時間持續呈現「黃金交叉」線型,元大寶華綜合經濟研究院今(26)日對此表示,M1B、M2年增率持續加速並創下2年多新高,反映市場上資金充沛,股市資金動能無虞,也可看出,在經濟情勢不佳下,貨幣政策略偏寬鬆,以提供充裕資金方式營造利於低迷景氣回溫的環境。

台幣在2014全年是低檔震盪,台灣M1B、M2年增率持續加速,所以產生一段資金行情。

11月狹義貨幣供給M1B較上月增加0.41%,重新恢復成長態勢,廣義貨幣供給M2月增0.34%,連續第7個月增加;元大寶華指出,就年增率而言,M1B由上月的8.58%持續加速至8.85%,創2011年3月後新高,而受到銀行對公營事業及民間部門放款與投資加速成長,以及外資持續淨匯入影響,M2年增率由上月的5.99%持續加速至6.05%,創2011年8月後最快紀錄,持續逼近6.5%目標區上限。

觀察前11月,在外資淨匯入與銀行授信成長下,M1B及M2平均年增率分別為7.16%及4.69%,其中M2持續處在央行2.5%-6.5%的目標區內,反映市場資金足以支應經濟活動所需,且略高於目標區中值4.5%。元大寶華指出,此反映在經濟情勢不佳下,貨幣政策偏寬鬆,以提供充裕資金促使景氣回溫。

11月狹義貨幣供給M1B較上月增加0.41%,重新恢復成長態勢,廣義貨幣供給M2月增0.34%,連續第7個月增加;元大寶華指出,就年增率而言,M1B由上月的8.58%持續加速至8.85%,創2011年3月後新高,而受到銀行對公營事業及民間部門放款與投資加速成長,以及外資持續淨匯入影響,M2年增率由上月的5.99%持續加速至6.05%,創2011年8月後最快紀錄,持續逼近6.5%目標區上限。

另外,M1B連續第14個月高於M2年增率,呈黃金交叉狀態,且缺口放大至2.8個百分點,M1B、M2日平均餘額也分別以13.1兆元、35.2兆元續創新高,反映市場上資金充沛,股市資金動能無虞。

觀察前11月,在外資淨匯入與銀行授信成長下,M1B及M2平均年增率分別為7.16%及4.69%,其中M2持續處在央行2.5%-6.5%的目標區內,反映市場資金足以支應經濟活動所需,且略高於目標區中值4.5%。元大寶華指出,此反映在經濟情勢不佳下,貨幣政策偏寬鬆,以提供充裕資金促使景氣回溫。

+20131222.png)

資金行情助攻,春節前上看8800(康和投顧提供)

受到FOMC會議結果將在台北時間週四凌晨公佈,投資人觀望氣氛濃厚,週二晚間的歐美股市呈現小幅震盪,週三台股亦不例外,週三全天震幅不到45點,外資持股比重較高的半導體權值股,如台積電(2330)、日月光(2311)和聯發科(2454),周三股價跌幅皆超過1%以上,壓抑台股無法突破10日均線(8381.91點)反壓,終場台股下跌3.89點或0.05%,收在8349.04點,成交量能則小幅放大至734.36億元。

在全球金融市場接籠罩在QE是否在本周退場的不確定性下,投資人觀望,股市波動不大。在考量財政協議尚未在參議院過關、且2014年美國依舊將面臨舉債上限的困擾下,本週FED執行QE退場的機率不高,因此就台股而言,資金行情仍將推升台股,預期農曆年前,台股可望上看8600~8800點。不過須留意12月中下旬將是外資休長假時期,資金動能將趨緩,預期此段時間台股將在8400點附近上下震盪,待來年開春後,資金行情點燃台股多頭火苗,而後指數上攻,因此就中長線的操作上,建議可逢低建立持股部位。在類股的選擇上,首選金融權值股,建議可逢低建立中長線持股。(康和投顧提供)

( 註:過去 M1B 大漲後通常有一波台股資金行情,這次又要看央行操作了,自已經驗裡投資大賺期間也是在M1B 大漲後,政府如何做是重點,但 2025 M1B、M2是衰退 )

Related articles

+20131222.png)