台灣週刊之前曾報導大陸有攻台計畫,但如果從出口數據判斷,南韓老早成為大陸產業自主所要搬走的絆腳石,供應鍊斷鍊危機已是現在進行式。

大陸是南韓最大貿易伙伴,但南韓國貿局看了進出口報告、出口連續三個月下滑且 7 月年減幅來到 7% 之後,也不免透露感到憂心忡忡。

華爾街日報 21 日報導,南韓官員將難看的出口數字歸咎於大陸供應商自製能力日益精進,使得對韓採購需求下滑。過往,陸廠多倚賴進口南韓半成品與零組件,組裝之後再銷往第三地,但現在陸廠技術升級後,已能取而代之。

南韓石化業是大陸產業自主化最大的受害者之一,數據顯示,7 月韓國出口至大陸的石化業產品衰退了 5.9%。韓國智庫國際政經院( Institute for International Economic Policy )曾警告,大陸石化業產能快速提升,加上國內經濟成長放緩,勢必降低進口量。韓國唯一 CPL 廠 Capro 三座廠房去年關掉一座就是因為大陸接單減少。

南韓財政部曾呼籲南韓企業,過於依賴半成品的出口模式必須作修正,但即便是如此,晉升至高階產品還是難逃被陸廠追打的命運,如小米手機第二季就已取代三星成為大陸手機第一品牌。

取代 Samsung 長達兩年的寶座,小米手機第二季在中國市場稱王

在把持中國市場長達兩年之後,Samsung 第一的寶座終於被小米給取代。從 Canalys 釋出的

數據顯示,小米手機第二季在中國的出貨數據為 14,991,570 台,領先第二位的 Samsung 約有 170 萬台左右的數據,以 14% 的市場佔有率排在第一位。

中國市場第二季的智慧型手機銷售超過 1 億台。

Samsung 與第三位的 Lenovo 同樣擁有 12% 的市場佔有率,不過後者稍微落後 Samsung 約 200,000 台。

從 2012 年第一季開始,Samsung 就一直在中國呈現領先的角色;當時,最高市場佔有率最高為 22%。Samsung 智慧型手機從高階到低階,種類相當多,但碰到以高規格、低價的小米後,整個市場逐漸被翻轉了起來,特別是中低階產品,Samsung 在中國市場無法吸引消費者買單。

即使每一次開賣都無法滿足所有消費者,但上半年 2,610 萬台的整體銷售數據,似乎在說明這家智慧型手機品牌在中國的影響力可能比大家想像的要高出許多。此外,小米手機創辦人雷軍對於全年 6,000 萬台的銷售數據仍持有相當大的信心,並多次在公開場合認為這個數據絕對可以達成。

包含中國市場在內,全球已經開始迎接 4G LTE 的到來,但小米公司到目前為止並沒有針對這部份下太多功夫,在 2014 下半年是否會讓其他品牌超前,仍是一個未知數。可是,我們可相當確定一點,那就是小米的破壞式銷售結構將會持續,並且打擊到 Sony、HTC 以及 Samsung 等國際知名品牌的銷售。

Huawei sees strong H1 sales growth, smartphones lead the charge

Despite concerns that the smartphone market is reaching saturation point, at least at the premium end of the market, some manufacturers are still managing to post impressive growth figures this year. Huawei is the latest consumer electronics company expected to announce strong sales growth last quarter, led by the company’s smartphone division. According to a memo seen by The Wall Street Journal, sales of Huawei smartphones, and other consumer products, rose by 30 percent in the first half of this year.

In a business memo sent out to colleagues titled “Don’t Fall Behind”, Richard Yu, the head of Huawei’s consumer business group which mainly deal with smartphone sales, said that his group had already reached half of its 2014 profit target in the six months which ended on June 30th. Contrary to some analyst concerns about the top end of the market, Huawei’s strategy of focusing more on mid- to high-end smartphones, such as the Ascend Mate 2 and Ascend P7, rather than selling the cheapest phones on the market, seems to be paying off.

Although Huawei has not disclosed any sales figures yet, Huawei has said that its revenue rose by 19 percent in the first half of this year. Last year Huawei’s consumer electronics business generated 70 percent of its revenue from telecommunications sales, so we can assume that the growth in the smartphone division is having a very positive impact on the company’s profit margins.

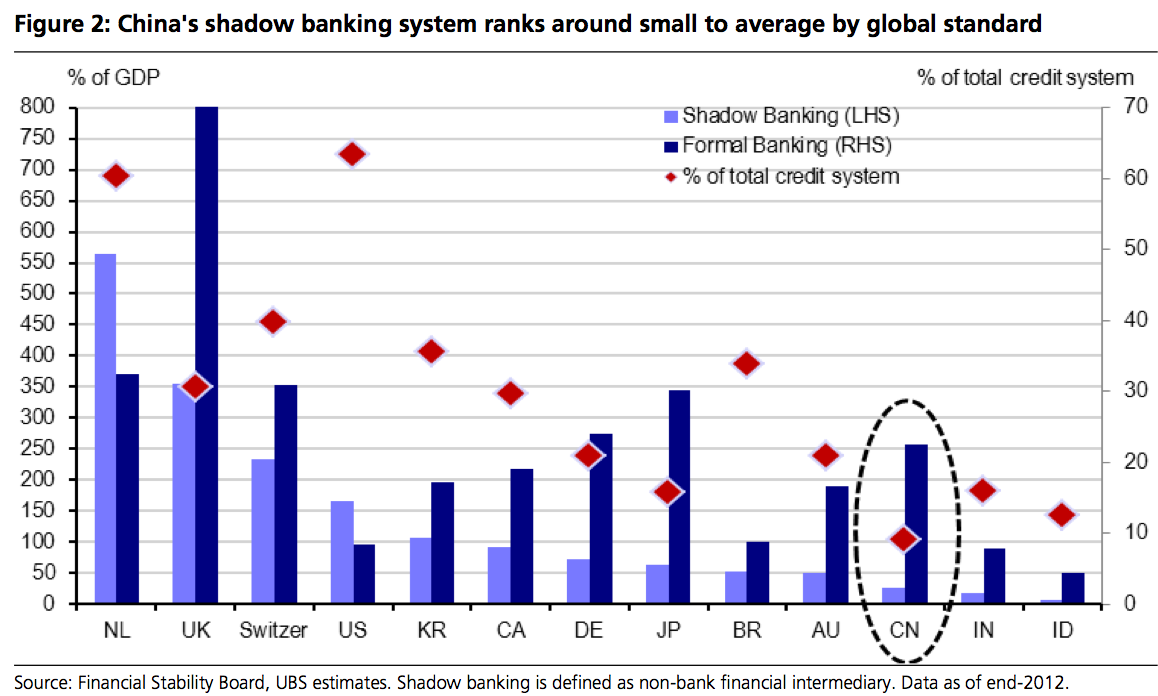

Despite Huawei’s strong growth so far this year, the company is still a way behind the market leaders, Samsung and Apple, when it comes to its global sales share. The latest research from IDC puts Huawei on just 5 percent of the global market, compared with 30 percent for Samsung and 16 percent for Apple.

Even so, Huawei’s business strategy seems better suited to the current market climate than its larger rival Samsung, which is expecting to post a poor Q2 earnings report. It seems likely that Huawei is set to retain its position as the third largest smartphone manufacturer in the world, with most of its growth coming from emerging markets.

According to the memo from Mr Yu, Huawei is seeing its strongest levels of sales growth in the northern portion of Latin America, particularly in Mexico, Colombia, Venezuela and Ecuador, followed by the Middle East, Africa, and Southeast Asia.

If you’re interested in a further breakdown of how Huawei’s mobile business is faring, the company is scheduled to announce its financial results next week.

Huawei sees 62% bump in first-half smartphone sales, commits to 80M shipments in 2014

Huawei said its smartphone shipments jumped 62 percent year-over-year in the first half of 2014 and that it is on pace to reach its goal of shipping 80 million smartphones for the full year.

Huawei said its smartphone shipments jumped 62 percent year-over-year in the first half of 2014 and that it is on pace to reach its goal of shipping 80 million smartphones for the full year.

The Chinese network equipment and device vendor said that it shipped a total of 64.21 million devices in the first half, including 34.27 million smartphones. That brings the company to around 43 percent of its smartphone shipment goal for 2014.

"Based on the growth momentum at the moment, we are firmly moving toward our full-year target," Shao Yang, vice president of marketing in the consumer business group, told Reuters in a written statement. Huawei said in March it would ship 80 million smartphones in 2014.

三星利潤大滑25%:國產廠商搶食手機份額

三星手機半年來的乏力,終於得到官方數據的證實。

7月8日,三星電子發佈今年二季度業績預告,銷售額為52萬億韓元(515億美元),同比下滑約10%;運營利潤為7.2萬億韓元(71億美元),同比下滑約25%。“國產廠商的產品能力上來了。”7月9日,一位手機渠道人士對21世紀經濟報導記者表示,配置類似、體驗相當的產品,三星還維持兩三倍以上的定價,“高高在上,消費者不是傻瓜,當然不好賣了”。

由於手機業務所在部門為三星電子貢獻了接近70%的運營利潤,手機業務的景氣度直接影響著整個公司的業績走向。面對這份羸弱的數據,三星電子罕見地在業績預告數據後附上了原因分析,其中提及韓元升值不利因素的同時,亦毫不諱言中國手機廠商的競爭威脅。

比較優勢不再

“今年4月份還在賣去年12月壓的貨。”一位手機渠道商內部人士對21世紀經濟報導記者表示,今年以來,三星部分產品的存貨周期長達12-14周,而其好的時候可以控制在3-4周,“周期延長勢必導致存貨跌價”。

該渠道人士表示,儘管三星為穩住渠道商,推出了保價政策,但清庫存還是傷了很多渠道。“產品沒以前好賣,說到底就是比較優勢不明顯了。”一位手機廠商負責人表示,以三星今年的旗艦機S5為例,定價超過5000元,而華為P7、酷派大觀等國產廠商的產品在配置上相差不大,同為Android操作系統,使用體驗上各有千秋,但價格往往只有三星S5的一半甚至更低。

水貨市場可以作為觀察一款產品活躍度的鏡子。有業內人士告訴21世紀經濟報導記者,三星S5剛上市時水貨價在4500元左右,二三個月後水貨市場的報價已經下降到3300元左右。

另一方面,隨著智能手機的不斷普及,高端市場增長趨緩,市場增量快速轉移到中低端產

品上。中國市場尤其如此,由於運營商補貼的推動,1500元以下的千元智能機占據了市場絕大部分比重。但三星的產品線佈局主要在1500元以上區間,這影響了整體銷量。“三星也有1500元以下的產品,但同樣的價格,晶元、屏幕等配置要比國產廠商差一大截。”前述手機業內人士認為,在目前的產品策略和定價策略之下,三星在中低端市場很難與國產廠商競爭。

三星產品的比較優勢不斷下滑,也體現在其中國市場的份額不斷下滑。市場研究公司Strategy Analytics 公佈的數據顯示,去年第二季度,三星在中國售出了1530萬台智能手機,市場份額為19.4%。而根據賽諾的數據,今年5月份,三星在中國的銷量市場份額已經下滑到16.5%,環比下降0.5%,而同期酷派、聯想的市場份額均已超過 10%,與三星的差距在不斷縮小。

由於中國市場對三星的貢獻值,三星在中國市場份額的下降直接影響到其全球的業績。根據三星2013年年報披露的數據,2013財年,僅中國單一國家,為三星貢獻的營收占比高達18%。

或許是鑒於這一形勢,三星電子在上個月對其大中華區移動通信事業部負責人進行了調整,原三星電子大中華區移動通信事業部總裁李鎮仲調回南韓總部,該職位由原三星電子大中華區執行副總裁王彤接任。中國市場走淡的同時,為三星貢獻23%營收的另一糧倉——歐洲市場也遇到困難。三星在歐洲手機市場的份額高達40%,但目前面臨存貨上升的壓力。

“智能手機的過度供給導致中國和歐洲市場供過於求,低端市場的競爭越發激烈。”三星在解釋二季度業績滑坡時表示。三星還表示,今年以來,韓元兌美元的升值態勢幾乎不可阻擋。今年二季度,韓元對美元升值5.2%,而一年前同期韓元對美元貶值2.6%。本幣貶值有利於提高企業出口產品的競爭力,反之亦然。三星在2008年全球金融危機後的快速複蘇很大程度上就得益於韓元的疲軟。

國際數據公司稱,第二季度華為發貨量較上年同期增長了95%,而聯想集團的發貨量增長了39%。兩家公司的增幅都超過了23%的智能手機市場整體增幅。而全球最大的智能手機製造商三星電子的發貨量下降了3.9%。

雖然中國的智能手機市場已經逐步飽和,但亞洲、拉丁美洲和非洲等新興市場的需求非常強勁,許多消費者仍計劃更換他們的基本功能手機。

國際數據公司資深研究經理 Melissa Chau 在聲明中稱,隨著基本款手機的淘汰速度加快,中國手機製造商已經為引導新興市場消費者使用智能手機做好了準備。

第二季度華為成為全球第三大智能手機製造商,在該市場的佔有率從上年同期的4.3%升至6.9%。雖然相比於三星電子及蘋果公司(Apple)仍有較大距離,但華為與這兩個市場領導者之間的差距在縮小。三星電子的市場份額從上年同期的32%降至25%,而蘋果公司的市場份額從13%略微降至12%。

4G未知數

手機方案商龍旗的副總劉渝龍表示,三星目前的問題核心是產品力不足,高端市場受到蘋果擠壓,尤其是蘋果下一代產品如傳聞所言將推大屏產品,直接受影響的將是三星;中低端市場又受到中國廠商的搶食。

“三星手機目前的遭遇是多重因素造成,比如掌門人李健熙病重導致的內部混亂。”劉渝龍強調,“三星不缺製造能力,只要策略轉過來,有人來抓,可以很快恢復過來”。也有國產手機業內人士持不同觀點,認為三星在4G時代將面臨中國廠商更激烈的競爭。

賽諾的數據顯示,今年5月,酷派以23.1%的份額位居國內4G手機市場第一位,三星和蘋果分列第二和第三。儘管這是單月數據,但也在一定程度上顯示國產廠商在4G上的進攻性,酷派目前已推出多款千元價位的4G手機。

前述國產手機廠商人士表示,目前中國手機廠商的戰法頗有“殺敵一千、自損八百”的意味,多家廠商的出貨量進入了全球前十,但盈利能力普遍孱弱,毛利率在10%左右,凈利率只有2%,走在盈虧平衡的邊緣。

“同為Android陣營,三星面臨中國廠商的低毛利競爭。”該人士認為,這對三星提出了考驗,即充分利用其產業鏈優勢和全球規模化佈局,發力中低端市場,“這是策略問題”。

今年5月華為在巴黎發佈P7時,華為消費者BG(業務集團)CEO餘承東就曾在接受21世紀經濟報導記者採訪時暗示對三星的追趕之心,“目前市場排名的第二的廠商(指蘋果)因為有特殊的生態鏈,我不好講,但排名第一的那家(指三星),並沒有什麼華為不具備的競爭優勢”。

今年5月華為在巴黎發佈P7時,華為消費者BG(業務集團)CEO餘承東就曾在接受21世紀經濟報導記者採訪時暗示對三星的追趕之心,“目前市場排名的第二的廠商(指蘋果)因為有特殊的生態鏈,我不好講,但排名第一的那家(指三星),並沒有什麼華為不具備的競爭優勢”。

分析

Despite concerns that the smartphone market is reaching saturation point, at least at the premium end of the market, some manufacturers are still managing to post impressive growth figures this year. Huawei is the latest consumer electronics company expected to announce strong sales growth last quarter, led by the company’s smartphone division. According to a memo seen by The Wall Street Journal, sales of Huawei smartphones, and other consumer products, rose by 30 percent in the first half of this year.

In a business memo sent out to colleagues titled “Don’t Fall Behind”, Richard Yu, the head of Huawei’s consumer business group which mainly deal with smartphone sales, said that his group had already reached half of its 2014 profit target in the six months which ended on June 30th. Contrary to some analyst concerns about the top end of the market, Huawei’s strategy of focusing more on mid- to high-end smartphones, such as the Ascend Mate 2 and Ascend P7, rather than selling the cheapest phones on the market, seems to be paying off.

Although Huawei has not disclosed any sales figures yet, Huawei has said that its revenue rose by 19 percent in the first half of this year. Last year Huawei’s consumer electronics business generated 70 percent of its revenue from telecommunications sales, so we can assume that the growth in the smartphone division is having a very positive impact on the company’s profit margins.

Despite Huawei’s strong growth so far this year, the company is still a way behind the market leaders, Samsung and Apple, when it comes to its global sales share. The latest research from IDC puts Huawei on just 5 percent of the global market, compared with 30 percent for Samsung and 16 percent for Apple.

Even so, Huawei’s business strategy seems better suited to the current market climate than its larger rival Samsung, which is expecting to post a poor Q2 earnings report. It seems likely that Huawei is set to retain its position as the third largest smartphone manufacturer in the world, with most of its growth coming from emerging markets.

According to the memo from Mr Yu, Huawei is seeing its strongest levels of sales growth in the northern portion of Latin America, particularly in Mexico, Colombia, Venezuela and Ecuador, followed by the Middle East, Africa, and Southeast Asia.

If you’re interested in a further breakdown of how Huawei’s mobile business is faring, the company is scheduled to announce its financial results next week.

Huawei sees 62% bump in first-half smartphone sales, commits to 80M shipments in 2014

Huawei said its smartphone shipments jumped 62 percent year-over-year in the first half of 2014 and that it is on pace to reach its goal of shipping 80 million smartphones for the full year.

Huawei said its smartphone shipments jumped 62 percent year-over-year in the first half of 2014 and that it is on pace to reach its goal of shipping 80 million smartphones for the full year.The Chinese network equipment and device vendor said that it shipped a total of 64.21 million devices in the first half, including 34.27 million smartphones. That brings the company to around 43 percent of its smartphone shipment goal for 2014.

"Based on the growth momentum at the moment, we are firmly moving toward our full-year target," Shao Yang, vice president of marketing in the consumer business group, told Reuters in a written statement. Huawei said in March it would ship 80 million smartphones in 2014.

三星利潤大滑25%:國產廠商搶食手機份額

三星手機半年來的乏力,終於得到官方數據的證實。

7月8日,三星電子發佈今年二季度業績預告,銷售額為52萬億韓元(515億美元),同比下滑約10%;運營利潤為7.2萬億韓元(71億美元),同比下滑約25%。“國產廠商的產品能力上來了。”7月9日,一位手機渠道人士對21世紀經濟報導記者表示,配置類似、體驗相當的產品,三星還維持兩三倍以上的定價,“高高在上,消費者不是傻瓜,當然不好賣了”。

由於手機業務所在部門為三星電子貢獻了接近70%的運營利潤,手機業務的景氣度直接影響著整個公司的業績走向。面對這份羸弱的數據,三星電子罕見地在業績預告數據後附上了原因分析,其中提及韓元升值不利因素的同時,亦毫不諱言中國手機廠商的競爭威脅。

比較優勢不再

“今年4月份還在賣去年12月壓的貨。”一位手機渠道商內部人士對21世紀經濟報導記者表示,今年以來,三星部分產品的存貨周期長達12-14周,而其好的時候可以控制在3-4周,“周期延長勢必導致存貨跌價”。

該渠道人士表示,儘管三星為穩住渠道商,推出了保價政策,但清庫存還是傷了很多渠道。“產品沒以前好賣,說到底就是比較優勢不明顯了。”一位手機廠商負責人表示,以三星今年的旗艦機S5為例,定價超過5000元,而華為P7、酷派大觀等國產廠商的產品在配置上相差不大,同為Android操作系統,使用體驗上各有千秋,但價格往往只有三星S5的一半甚至更低。

水貨市場可以作為觀察一款產品活躍度的鏡子。有業內人士告訴21世紀經濟報導記者,三星S5剛上市時水貨價在4500元左右,二三個月後水貨市場的報價已經下降到3300元左右。

另一方面,隨著智能手機的不斷普及,高端市場增長趨緩,市場增量快速轉移到中低端產

品上。中國市場尤其如此,由於運營商補貼的推動,1500元以下的千元智能機占據了市場絕大部分比重。但三星的產品線佈局主要在1500元以上區間,這影響了整體銷量。“三星也有1500元以下的產品,但同樣的價格,晶元、屏幕等配置要比國產廠商差一大截。”前述手機業內人士認為,在目前的產品策略和定價策略之下,三星在中低端市場很難與國產廠商競爭。

三星產品的比較優勢不斷下滑,也體現在其中國市場的份額不斷下滑。市場研究公司Strategy Analytics 公佈的數據顯示,去年第二季度,三星在中國售出了1530萬台智能手機,市場份額為19.4%。而根據賽諾的數據,今年5月份,三星在中國的銷量市場份額已經下滑到16.5%,環比下降0.5%,而同期酷派、聯想的市場份額均已超過 10%,與三星的差距在不斷縮小。

由於中國市場對三星的貢獻值,三星在中國市場份額的下降直接影響到其全球的業績。根據三星2013年年報披露的數據,2013財年,僅中國單一國家,為三星貢獻的營收占比高達18%。

或許是鑒於這一形勢,三星電子在上個月對其大中華區移動通信事業部負責人進行了調整,原三星電子大中華區移動通信事業部總裁李鎮仲調回南韓總部,該職位由原三星電子大中華區執行副總裁王彤接任。中國市場走淡的同時,為三星貢獻23%營收的另一糧倉——歐洲市場也遇到困難。三星在歐洲手機市場的份額高達40%,但目前面臨存貨上升的壓力。

“智能手機的過度供給導致中國和歐洲市場供過於求,低端市場的競爭越發激烈。”三星在解釋二季度業績滑坡時表示。三星還表示,今年以來,韓元兌美元的升值態勢幾乎不可阻擋。今年二季度,韓元對美元升值5.2%,而一年前同期韓元對美元貶值2.6%。本幣貶值有利於提高企業出口產品的競爭力,反之亦然。三星在2008年全球金融危機後的快速複蘇很大程度上就得益於韓元的疲軟。

國際數據公司稱,第二季度華為發貨量較上年同期增長了95%,而聯想集團的發貨量增長了39%。兩家公司的增幅都超過了23%的智能手機市場整體增幅。而全球最大的智能手機製造商三星電子的發貨量下降了3.9%。

雖然中國的智能手機市場已經逐步飽和,但亞洲、拉丁美洲和非洲等新興市場的需求非常強勁,許多消費者仍計劃更換他們的基本功能手機。

國際數據公司資深研究經理 Melissa Chau 在聲明中稱,隨著基本款手機的淘汰速度加快,中國手機製造商已經為引導新興市場消費者使用智能手機做好了準備。

第二季度華為成為全球第三大智能手機製造商,在該市場的佔有率從上年同期的4.3%升至6.9%。雖然相比於三星電子及蘋果公司(Apple)仍有較大距離,但華為與這兩個市場領導者之間的差距在縮小。三星電子的市場份額從上年同期的32%降至25%,而蘋果公司的市場份額從13%略微降至12%。

4G未知數

手機方案商龍旗的副總劉渝龍表示,三星目前的問題核心是產品力不足,高端市場受到蘋果擠壓,尤其是蘋果下一代產品如傳聞所言將推大屏產品,直接受影響的將是三星;中低端市場又受到中國廠商的搶食。

“三星手機目前的遭遇是多重因素造成,比如掌門人李健熙病重導致的內部混亂。”劉渝龍強調,“三星不缺製造能力,只要策略轉過來,有人來抓,可以很快恢復過來”。也有國產手機業內人士持不同觀點,認為三星在4G時代將面臨中國廠商更激烈的競爭。

賽諾的數據顯示,今年5月,酷派以23.1%的份額位居國內4G手機市場第一位,三星和蘋果分列第二和第三。儘管這是單月數據,但也在一定程度上顯示國產廠商在4G上的進攻性,酷派目前已推出多款千元價位的4G手機。

前述國產手機廠商人士表示,目前中國手機廠商的戰法頗有“殺敵一千、自損八百”的意味,多家廠商的出貨量進入了全球前十,但盈利能力普遍孱弱,毛利率在10%左右,凈利率只有2%,走在盈虧平衡的邊緣。

“同為Android陣營,三星面臨中國廠商的低毛利競爭。”該人士認為,這對三星提出了考驗,即充分利用其產業鏈優勢和全球規模化佈局,發力中低端市場,“這是策略問題”。

今年5月華為在巴黎發佈P7時,華為消費者BG(業務集團)CEO餘承東就曾在接受21世紀經濟報導記者採訪時暗示對三星的追趕之心,“目前市場排名的第二的廠商(指蘋果)因為有特殊的生態鏈,我不好講,但排名第一的那家(指三星),並沒有什麼華為不具備的競爭優勢”。

今年5月華為在巴黎發佈P7時,華為消費者BG(業務集團)CEO餘承東就曾在接受21世紀經濟報導記者採訪時暗示對三星的追趕之心,“目前市場排名的第二的廠商(指蘋果)因為有特殊的生態鏈,我不好講,但排名第一的那家(指三星),並沒有什麼華為不具備的競爭優勢”。分析

- 中國智慧型手機品牌:華為、小米起飛,意味著中國大陸智能手機產業、電信產業及半導體產業將成為全球前兩大產業,台灣須非常小心,因為從中國大陸政府資金扶持 LCD、LED、太陽能產業,極力與台灣的產業競爭,變成大陸政府資金打擊台灣民間產業,而同期馬政府卻大幅增加政府經常性支出、公務員退休福利支出及降低勞工退休福利、國營單位亂漲價,配上許多不利於台灣之ECFA合約細項,當然造成台灣經濟大衰退、學運反服貿;

- 政府應該記取 ECFA 簽約後台灣經濟大衰退事實做檢討,更要了解既使台灣今年GDP成長率達到3.41% 還是亞洲倒數三名內,不要輕信加入 TPP、RECP 台灣GDP成長率就會大好,台商在大陸東協已經佈形成,加入 TPP、RECP 作用自然減少,但台灣中小企業仍在台灣的需產業升級,去結合越南、菲律賓、東協、土耳其、墨西哥簽FTA,讓台灣中小企業可以在較互補的產業國家FTA得著生存及產業升級,而不致在TPP、RECP 完全被中國大陸及南韓殲滅;

- 越南、菲律賓、馬來西亞是通東協、大陸貿易之重點,墨西哥是通北美、南美貿易之重點,土耳其是通歐洲之重點 );

- 中國大陸就透過 ECFA、貨貿( 部份商品 ),小心進行去彌補中韓簽FTA台灣出口中國大陸弱勢項目,以免造成更嚴重失業率及產業空洞亡國;

- ECFA 由政府主導,政府人員根本遠不如業者去中國大陸爭取之利益,所以當然造成台灣經濟大衰退;

- 從南韓出口連三衰,供應鍊早台灣一步斷鍊之憂心,不難看出中韓簽FTA對南韓極可能未必有利,狀況會類似兩岸 ECFA狀況,中韓簽FTA對台商在大陸已經佈形成非常有利,韓國不會因中韓簽FTA得利,因為中國對台、韓經濟戰略是相同的:吸收資金、技術、人才與投資,韓國比台灣更依賴中國市場,將來中國發生金融風暴反而讓韓國受傷更大,對台灣更有利;

- 中國大陸極力要與台灣、韓國、東協簽FTA,就是要吸收台灣、韓國之資金與技術,吸收東協物資與市場,同時擴大人民幣國際化將中國大陸高收債發行到海外,並將人民幣債風險擴及台灣,因為只有人民幣去化未完成,因此台灣的銀行承受之人民幣跌價風險在 2015 ~ 2016會拉高;( 註:中國大陸人民銀行已與40個國家與歐元區的中央銀行簽署2.7兆人民幣的SWAP,但台灣尚未簽署,亦影響人民幣去化,中國大陸對台灣仍存金融戰略之惡意有關。)